The Ethereum Foundation finally got tired of the old ’sell ETH to pay the bills’ routine. You know, like that one guy who always raids the office snack stash but never chips in.

Well, they’re flipping the script. Instead of dumping Ether, they’re stepping into DeFi, borrowing $2 million in GHO stablecoins from Aave.

Turning the tables

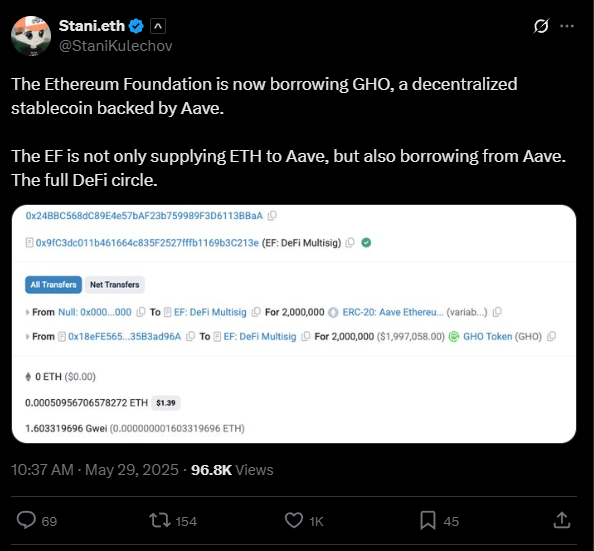

Stani Kulechov, the Aave founder, spilled the beans on May 29 via X, and said the Ethereum Foundation isn’t just handing over ETH to Aave anymore, now, they’re borrowing from it too.

It’s like lending your stapler to Jim at the office, then borrowing his fancy pen back later. This move signals a whole new level of treasury savvy, ngl.

What’s GHO? Glad you asked. It’s Aave’s own decentralized stablecoin, backed by collateral and governed by Aave’s DAO, no middlemen, no suits calling the shots.

Interest rates, collateral rules, all decided by the community. Unlike your usual centralized stablecoins that act like that boss who micromanages everything, GHO’s more like the cool manager who trusts the team.

No more dump, okay?

This isn’t the foundation’s first rodeo in DeFi, as back in February, they threw down 45,000 Ether, about $120 million across protocols like Aave, Spark, and Compound.

Kulechov called that their biggest allocation in DeFi yet, and he’s bullish, saying this move puts DeFi on the winning side.

The community’s cheering too, with people urging the foundation to keep playing smart and managing ETH holdings this way.

Why the change? Well, earlier this year, the Ethereum community was fed up with the foundation’s habit of selling ETH to cover expenses.

Eric Conner, co-author of the famous EIP-1559 upgrade, called selling insane and pushed for staking or borrowing stablecoins instead.

Anthony Sassano, sharp guy, host of The Daily Gwei, even suggested staking some ETH and selling the staking rewards, or borrowing stablecoins via Aave, to keep the foundation’s crypto stash intact.

Just in time

So, what’s the big deal here? Selling pressure will ease? The Ethereum Foundation’s move to borrow $2 million in GHO stablecoins shows they’re finally listening.

No more dumping ETH like it’s last season’s office memo. Instead, they’re adopting DeFi tools to keep their treasury healthy, flexible, and ready for the future.

In the end, it’s like the foundation started investing in a coffee machine that pays for itself. Smart, sustainable, and hey, if the Ethereum Foundation’s playing it this way, maybe the rest of us should take notes.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.