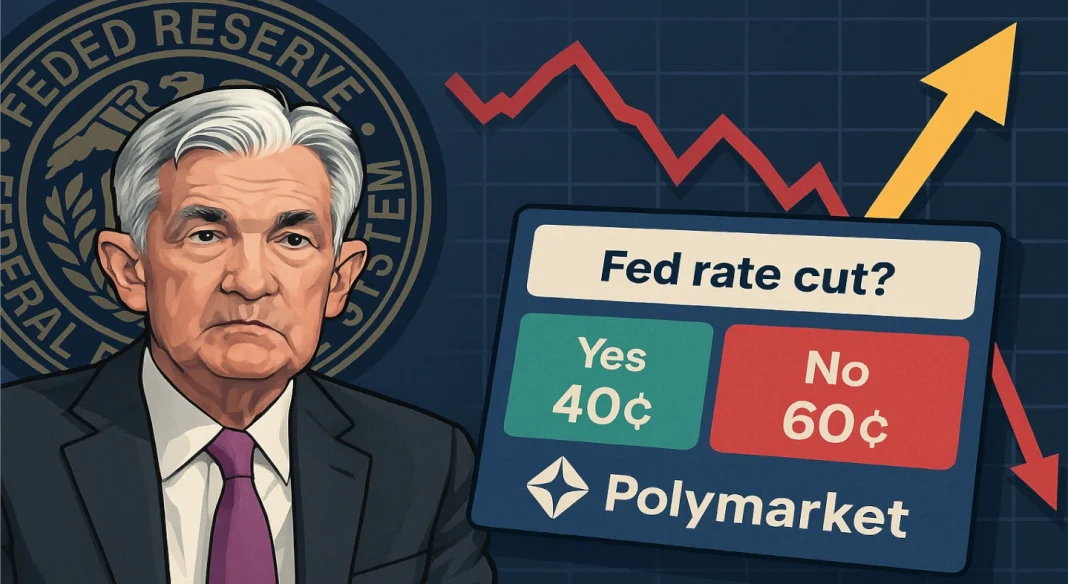

The people on Polymarket are throwing down their chips with 96.3% odds that the Federal Reserve’s gonna leave interest rates exactly where they’re at.

No rate cut coming next week, despite the boss, Donald Trump, calling for the Fed to ease those rates like it’s Black Friday and everyone’s fighting for a deal.

Cut?

Now, hold on. Just 3% of the bets lean towards a modest 25 basis-points cut. Anything bigger?

Barely a whisper, less than 1% are even thinking about a hike or a sharp cut.

It’s like everyone at the office agreeing they need one more coffee break before making any big decisions. No rush.

Trump’s been on a one-man crusade, rattling cages and jawing about how Fed Chair Jerome Powell should have moved sooner on cuts.

Take his recent stroll through the Fed’s renovation site, a real showstopper moment, where he called for big rate drops and threw out a staggering cost estimate of $3.1 billion for the makeover.

Powell wasn’t having it. He corrected that figure, saying the amount included an older building’s rehab from years ago.

It’s like the classic sitcom misunderstanding, you know, the wait, that’s not what I meant kind of scene.

Not today

Underneath all this, you’ve got the bigger tension, the Fed’s independence versus political pressure.

Trump’s even floated the idea of booting Powell before his term’s over, but here’s where the rubber hits the road.

According to Polymarket, the odds of Powell getting the boot by the end of this month sit at a meager 1%.

By August 31? Slightly higher, near 5%, and by the end of 2025, about 17%. So the big shake-up? Not happening tomorrow, guys.

Watching the numbers

What does all this mean? Polymarket’s crowd is basically betting that the Fed’s gonna stick to its usual script, steady as she goes, watching the data, ignoring the side chatter, and holding off on any rate cuts until they’re darn sure inflation and tariffs have played out.

So, in the big Fed show, the takeaway is this, no sudden moves, no surprise exits.

Just patience, poise, and a whole lotta watching the numbers before they make the next play.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.