What if Gary Gensler, the former SEC big boss, playing a two-faced game with crypto? Behind the curtain, he’s nodding along, whispering sweet nothings about blockchain’s promise.

But out in the public eye? He’s the crypto industry’s worst nightmare, cracking down like a big boss on a rival gang.

Sounds like a plot twist straight out of a mafia flick, right? Well, it’s real life, and it’s messy.

Double trouble

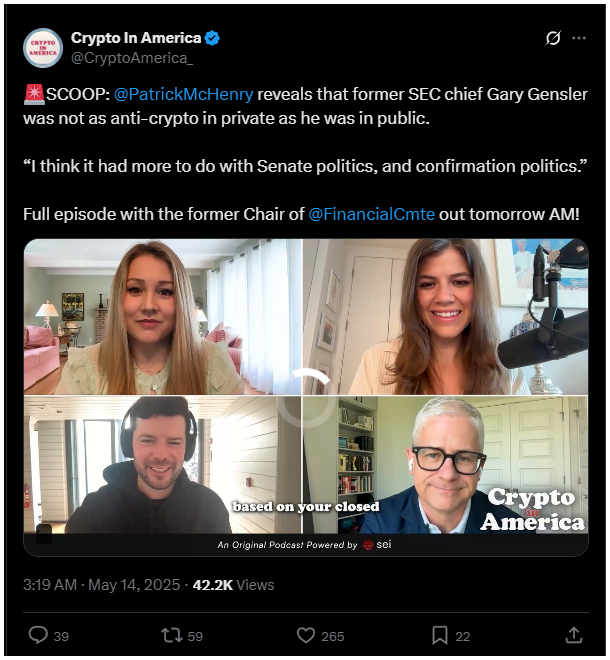

Patrick McHenry, the ex-US Representative and big dog of the House Financial Services Committee, spilled the beans in a podcast.

He said Gensler wasn’t nearly as anti-crypto in private as his public persona suggested. Not even close.

Behind closed doors, Gensler apparently saw the value of crypto assets and even acknowledged blockchain’s potential, drawing from his days teaching fintech at MIT.

Gerald Gallagher from Sei Labs chipped in, reminding us that Gensler helped pioneer the concept of crypto airdrops, something the industry still leans on heavily today. A forgotten chapter, maybe, but a telling one.

But then the plot thickens. Once Gensler donned the SEC chair’s hat, the tune changed dramatically.

McHenry admitted he had this weird, mistaken, stupid belief that Gensler wouldn’t turn out so tough.

Ha! Boy, was he wrong. Under Gensler’s watch, the SEC launched over 100 enforcement actions against crypto firms, hitting giants like Coinbase and Binance with lawsuits and fines. The industry saw it as a full-on assault, accusing Gensler of trying to unlawfully kill crypto.

Roleplaying

What’s behind this schizophrenic behavior? McHenry suggests it boiled down to good old Senate politics and confirmation pressures.

Gensler’s public hardline stance was more a political performance than a reflection of his true beliefs.

Conversations with him were reportedly confusing-he’d agree with a point, then flip-flop moments later. A classic case of saying one thing in the boardroom and another on the street.

Trustless

This double game shook trust in the SEC’s crypto rules, as the crackdown slowed U.S. crypto innovation while other countries raced ahead.

Even after Gensler stepped down in January 2025 and returned to MIT to teach fintech and AI, the fallout lingered.

Coinbase cut ties with law firms tied to former SEC officials, and Gemini refused to hire MIT grads unless Gensler was shown the door. Talk about collateral damage.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.