Grayscale witnessed a huge drop in its Bitcoin holdings since converting its Bitcoin Trust into an exchange-traded fund.

Sell

When Grayscale transitioned its Bitcoin Trust into an ETF back in January, the fund had around 620,000 Bitcoin.

By April, that number drastically decreased to 227,400 BTC, approximately $13.3 billion based on current prices.

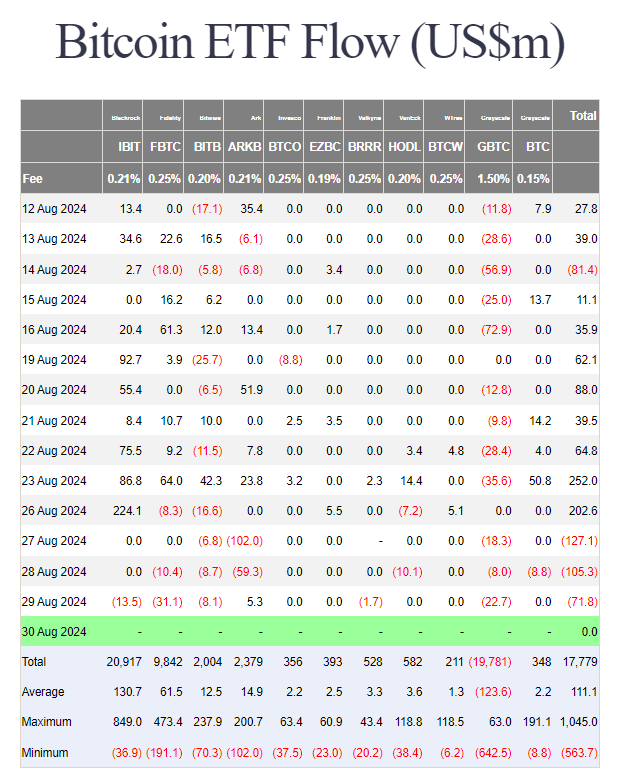

The ongoing outflows from the Grayscale Bitcoin Trust persisted since the ETF conversion, likely driven by higher than the competitors’ management fees and growing role of other funds such as BlackRock’s IBIT and Fidelity’s FBTC.

Buy

Once the largest Bitcoin ETF, GBTC has since been overtaken by BlackRock’s iShares Bitcoin Trust. It took five months after its launch to reach the top position.

This week alone, investors allocated more than $220 million into IBIT. IBIT has consistently seen net inflows since its inception, strenghtening its dominance in the Bitcoin ETF market. Their current holding is 358,000 BTC, valued at around $22 billion.

Market analysts are speculating on when GBTC’s decline in Bitcoin holdings might stop, as the outflows from GBTC already began to slow, with the ETF recording a net outflow of $8 million at the close of trading on Wednesday. This is the smallest withdrawal since mid-July.

Hold

Grayscale’s lower-cost Bitcoin Mini Trust, a newer addition to the company’s offerings, just experienced its first outflows in the past days.

Investors withdrew over $8 million from the Mini Trust on August 28, and this is the first bigger withdrawal since launching in late July.

The Mini Trust still managed to attract nearly $350 million in net capital, gradually closing the gap with competing funds from Invesco and Franklin Templeton.

Grayscale’s new fund, and the inflows’, outflows’ dynamics are the clear evidence of the intense competition within the Bitcoin ETF market as more and more big name want a slice from the pie.