Harvard University, one of the most conservative and influential institutions in global finance, just sent a shockwave through Wall Street.

The school’s $50 billion endowment has tripled its position in BlackRock’s iShares Bitcoin Trust (IBIT), pushing Bitcoin ahead of tech heavyweights like Microsoft and Amazon inside Harvard’s portfolio.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Over $442 million in Bitcoin ETF exposure

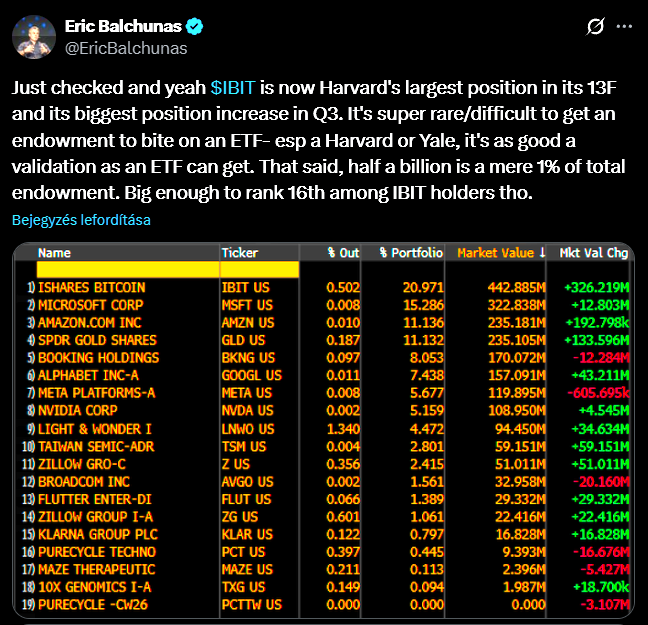

Bloomberg senior ETF analyst Eric Balchunas first flagged the move: Harvard increased its IBIT holdings by $326 million in Q3 2025, bringing its total exposure to more than $442 million.

That means Bitcoin now accounts for nearly 21% of Harvard’s reported portfolio — its single largest individual holding.

But there’s nuance here. Even after tripling the position, Bitcoin still represents less than 1% of Harvard’s overall endowment.

Still, in institutional finance, this is a bold signal: Bitcoin ETFs are no longer fringe experiments.

They are becoming legitimate components of long-term, regulated investment strategies.

Bitcoin ETFs keep absorbing capital

BlackRock’s iShares Bitcoin Trust remains the clear leader in the spot Bitcoin ETF market, sitting at roughly $80 billion in assets, nearly four times larger than Fidelity’s Wise Origin Bitcoin Fund.

And despite occasional outflows, demand remains strong.

More than $60 billion has flowed into U.S. spot Bitcoin ETFs since they were approved in early 2024 — a tidal wave of institutional capital.

Crypto ETFs outside Bitcoin continue to struggle

The same can’t be said for other crypto-based ETFs.

Spot Ether ETFs are leaking assets, and altcoin funds tied to XRP, Litecoin, or Solana remain tiny by comparison.

The divide highlights a growing reality: institutions want Bitcoin, not a basket of speculative tokens.

Analysts warn of one additional pressure point — Bitcoin’s price decline is pushing mining profitability closer to breakeven. If miners face sustained stress, it could create new volatility in the market.

Harvard’s message to Wall Street: Don’t ignore Bitcoin

Despite the uncertain macro backdrop, Harvard’s massive increase in Bitcoin ETF exposure sends a clear institutional message:

Bitcoin has crossed the threshold from experiment to essential allocation.

For an endowment known for caution, discipline, and generational planning, this move is a powerful endorsement.

If Harvard is scaling up its exposure, other major institutions won’t want to be the last ones standing on the sidelines.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: November 16, 2025 • 🕓 Last updated: November 16, 2025

✉️ Contact: [email protected]