Cardano’s founder is calling for a full-blown audit of Input Output Global, the company behind Cardano.

The community’s buzzing with serious accusations that IOG mishandled a 600 million ADA tokens, worth over $318 million.

ICO distribution?

Back in 2017, Cardano’s ICO left a pile of ADA tokens unclaimed. Fast forward to the Shelley upgrade in 2020, which pushed Cardano toward full decentralization, and those tokens suddenly became unspendable.

IOG moved those unclaimed tokens to keep the upgrade running smoothly. Sounds reasonable, right?

But some people aren’t buying it. They’re crying foul, accusing IOG of misusing those tokens, even calling it financial misconduct.

Hoskinson’s not taking this lying down, and he’s denied the allegations flat out and announced an independent audit to clear the fog, trying to calm the storm and bring some transparency to the chaos.

“We are initiating a comprehensive audit to set the record straight.”

Controversies

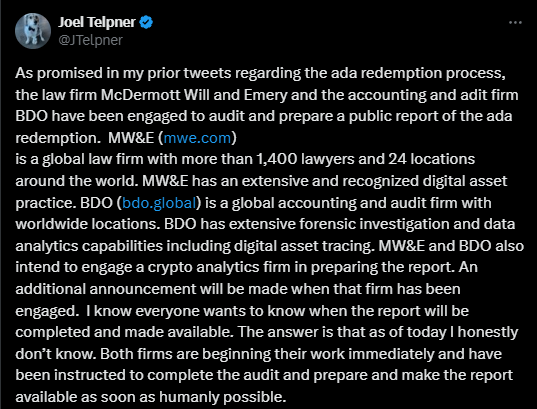

Who’s running this audit? IOG’s Chief Legal Officer, Joel Telpner, spilled the beans, and revealed that top-notch legal and accounting firms are on the case.

BDO International is handling the financial side, McDermott Will & Emery is overseeing the legal part, and a crypto analytics firm will document everything for the public.

No word yet on when we’ll see the results, but the clock’s ticking.

Now, Hoskinson isn’t just brushing off the accusations, he’s feeling the heat personally too. The guy’s talking about handing over his social media accounts to a team because the attacks are getting under his skin.

This ain’t his first rodeo tho, past controversies, like the WALDE memecoin drama, had him allegedly thinking about stepping back before.

Benchmark

This whole mess raises big questions about how crypto projects handle unclaimed ICO funds.

If this audit goes well, it could set a new standard for transparency in the space and help Cardano and IOG rebuild their battered reputations.

If not, well, you can guess what’s next. This audit could be Cardano’s make-or-break moment.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.