Metaplanet’s story in 2025? Once a hospitality company, now a full-on Bitcoin warrior.

It’s like watching a scrappy upstart outclass the big dogs, like Toyota, Sony, Mitsubishi, and leave ’em all in the dust. You wanna talk numbers? Let’s talk numbers!

Dominated by blue-chip giants

Metaplanet was humble, no fancy fireworks. But then, in late 2024, they pulled a fast one, pivoted hard into Bitcoin accumulation.

Started stacking digital gold like a boss, buying regularly and large.

The move was crazy, even gutsy, considering the stock scene in Japan, dominated by blue-chip giants with decades of steam.

Raising $3.7 billion

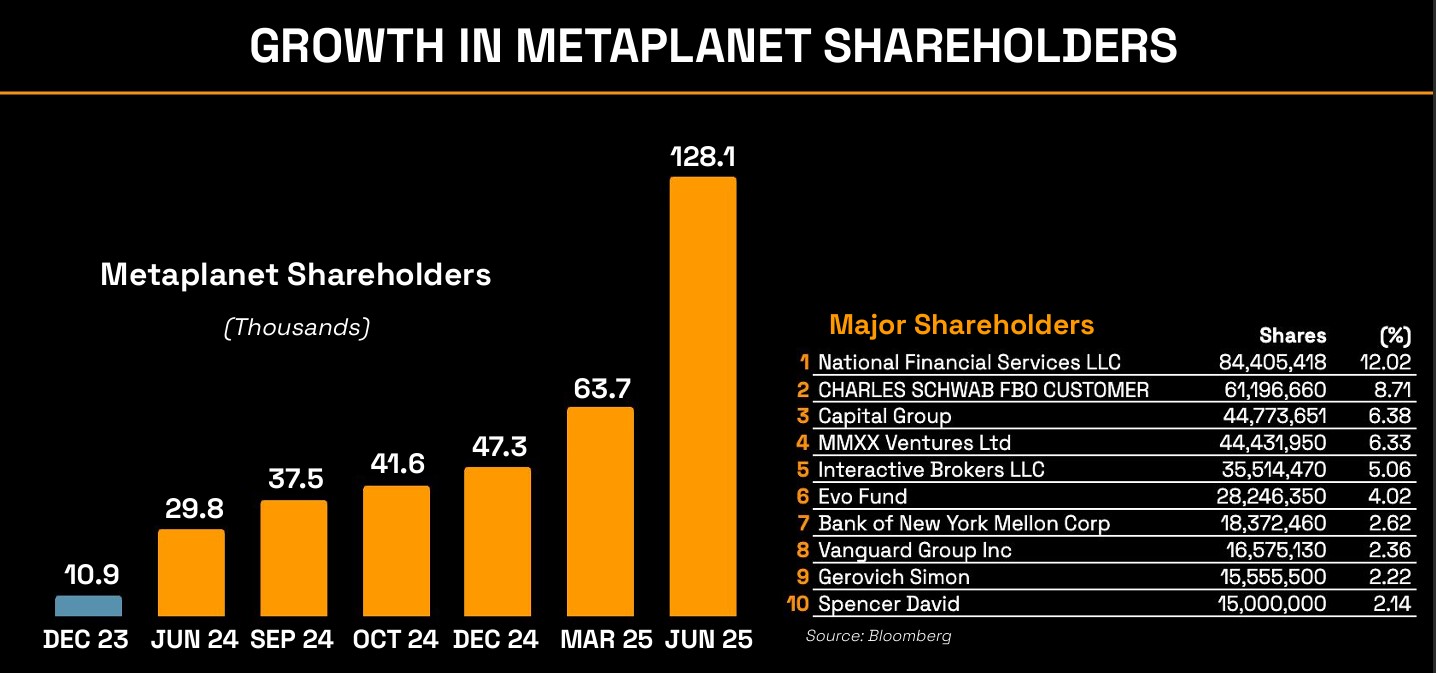

Then, the big play, Metaplanet’s performance in 2025 is nothing short of explosive. Year-to-date, the company’s stock grew nearly 190%, blowing past the TOPIX Core 30’s modest 7% gain.

For the average investors that’s a thorough knockout punch to giants like Mitsubishi, Nintendo, and SoftBank Group.

On the earnings front, they flipped a ¥5 billion loss into a jaw-dropping ¥11 billion profit in Q2 alone, thanks mainly to their Bitcoin stash appreciating like crazy.

Over 18,000 BTC now in the vault, with more than 16,000 added this year, racking up unrealized gains north of $340 million.

But the grand masterstroke? Metaplanet just announced plans to raise $3.7 billion through stock offerings, aiming to grab one percent of all Bitcoin by 2027, that’s 210,000 BTC.

Picture this like a big boss staking out territory, planning a crypto empire twice over in the next couple years.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Calculated risk

Metaplanet’s CEO Simon Gerovich calls this their strongest quarter in history. No idle words there.

This story? It’s raw ambition, calculated risk, and the hunger to redefine what a Japanese public company can be in the crypto age.

You know in the office when the quietest guy suddenly nails the big presentation and everyone’s jaw drops? That’s Metaplanet right now.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 14, 2025 • 🕓 Last updated: August 14, 2025

✉️ Contact: [email protected]