Hungary has enforced strict penalties on unlicensed crypto trading and services. The new Hungarian Criminal Code update took effect on July 1.

It introduces prison sentences for both individuals and companies involved in unauthorized crypto exchanges.

Anyone who trades crypto using an unauthorized crypto exchange could face up to 2 years in prison. The law applies to transactions worth between 5 million and 50 million forints (about $14,600 to $145,950).

The penalty rises to 3 years if the amount traded falls between 50 million and 500 million forints (about $145,950 to $1.46 million). Offenses over 500 million forints carry up to 5 years in prison.

These changes aim to address what lawmakers define as the “abuse of crypto-assets.” The new crypto regulation Hungary applies to all individuals who use platforms that have not received official approval.

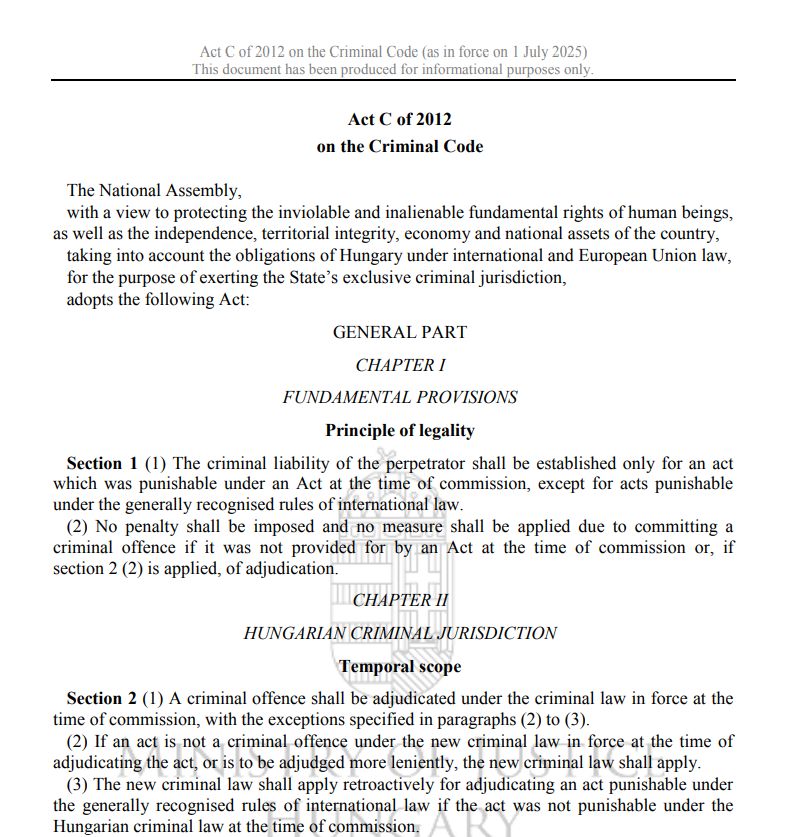

An excerpt from the National Legislation Database of Hungary confirms the penalties and value tiers under the updated law.

Prison Terms Also Target Unauthorized Crypto Service Providers

The law does not stop at crypto users. It also targets people and entities providing unauthorized crypto exchange services.

Under the updated Hungarian Criminal Code, these providers now face up to 3 years in prison if the trade volume is below 50 million forints.

If they conduct unlicensed services involving 50 million to 500 million forints, the sentence can reach 5 years. For volumes over 500 million forints, the prison term can go as high as 8 years.

Hungary’s Supervisory Authority for Regulatory Affairs (SZTFH) has been given 60 days to create compliance guidelines. However, crypto regulation Hungary still lacks a published framework.

Local outlet Telex reported on July 1 that crypto service providers are confused by the law’s rollout. With no clear definitions or registration process shared yet, many platforms remain unsure about how to meet the new legal standards.

The absence of SZTFH crypto guidelines has caused uncertainty across the market. The penalties are enforceable now, but legal pathways for compliance remain unclear.

Revolut Pulls Services, Restores Withdrawals in Hungary

The new law immediately affected crypto services. UK-based fintech platform Revolut disabled crypto functions for users in Hungary. The company cited “recently introduced Hungarian legislation” on its local website.

As of early July, Revolut stopped all crypto trading Hungary services, including both purchases and withdrawals. The company did not say when full services would return.

However, by mid-July, local outlet Portfolio reported that Revolut crypto Hungary had reinstated withdrawal functionality only. Trading remains disabled.

Revolut also announced that its EU branch is working on obtaining a full crypto license under the European Union framework.

This situation follows broader regulatory shifts across Europe. While Hungary crypto law is not yet connected to the MiCA (Markets in Crypto-Assets) framework, similar enforcement patterns are becoming more common in the region.

The updated Hungarian Criminal Code does not explain how existing foreign platforms should comply. Until SZTFH crypto guidelines are released, crypto exchanges, wallet providers, and users face legal risk if they operate without authorization.

Hungary’s new crypto regulation introduces some of the strictest penalties in the European region for unlicensed digital asset trading and service provision.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.