The elephant in the room now is the U.S. economy. It’s limping along like a wise guy after a bad night at the tables.

The latest numbers? They’re ugly. GDP for the first quarter? Supposed to go up, but instead it tripped and fell flat, turning negative when all the experts expected a gain.

The Fed's worst nightmare just got worse:

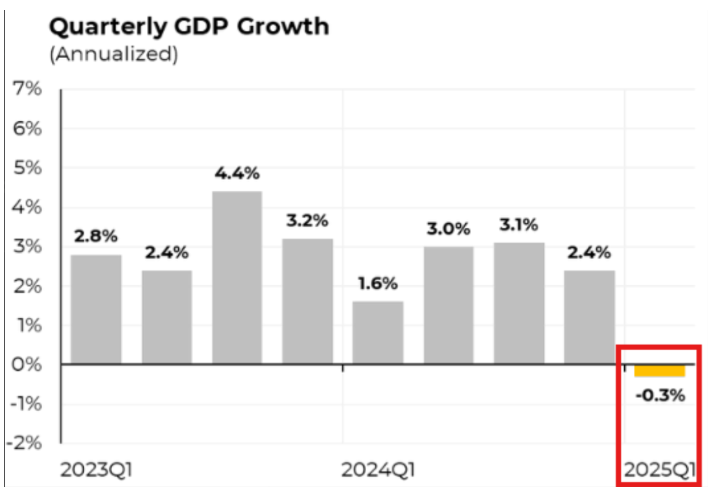

New data showed that US GDP CONTRATCTED by -0.3% in Q1 2025, while +0.3% growth was expected.

To make things worse, the GDP Price Index surged to +3.7%, its highest since August 2023.

What does Powell do now?

(a thread) pic.twitter.com/8ZNeRp4IQv

— The Kobeissi Letter (@KobeissiLetter) April 30, 2025

Between a rock and a hard place

Now, the Federal Reserve’s got a real problem on its hands, like a capo who’s gotta choose between paying off the boss or keeping the crew happy.

Inflation’s creeping up, unemployment’s threatening to join the party, and the Fed’s stuck in a lose-lose.

Cut rates and risk inflation? Or hold steady and watch jobs disappear? That’s what you call a nightmare scenario.

Analysts like the wise guys at The Kobeissi Letter say a recession in 2025 isn’t just possible, but it’s the base case.

The default. You know things are bad when the best-case scenario is not great.

The odds of a rate cut at the Fed’s May meeting? Practically zero. Maybe June, if you’re lucky, and even then, the market’s only giving it a 63% shot. Everyone’s holding their breath, waiting for the Fed to blink first.

Safe haven?

But here’s where it gets spicy, because it looks like Bitcoin might be the only one smiling through the chaos.

See, when the economy gets shaky, people start looking for a safe place to stash their cash.

And lately, Bitcoin’s been flexing. After a rough patch in early 2025, it bounced back hard, climbing 24% off its April lows and now hovering around $95,000, just a hair under its all-time high of $109,000 from January. Honestly, that’s a comeback worthy of a Hollywood script.

And get this, Bitcoin’s apparent demand has finally turned positive after months in the gutter.

Wallets are filling up again, and while the big Wall Street money isn’t pouring in like it did last year, the regular people are holding strong.

Some analysts are even whispering about a summer rally to $150,000 if things keep heating up.

Chances

When the Fed’s indeed stuck between a rock and a hard place, and the economy’s looking shakier than a stack of poker chips, Bitcoin could be the last man standing.

Maybe you don’t trust the banks. Maybe you don’t trust the government.

But when the world’s on fire, sometimes you gotta bet on the guy who’s already been through a few brawls and come out swinging. And now, it’s probably the Bitcoin.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.