Crypto traders are dumping XRP hard right now, with spot volumes spiking and price dipping below $2.

But on-chain and order book data tells a quite different story, Wall Street desks and large institutions are scooping up the distressed supply at these levels.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

A rare buy signal is flashing, one that’s historically preceded big rallies.

So is this just retail fear, or are the smart money players positioning for the next leg up?

What the Data Actually Shows Right Now

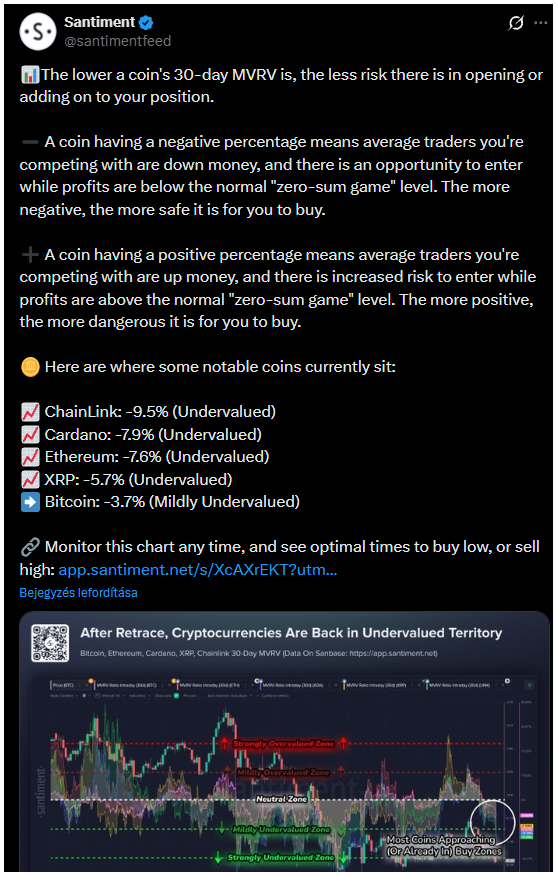

Santiment’s number highlights a clear divergence, retail panic-selling vs. institutional accumulation.

On-chain metrics back it up, large wallet inflows to custody addresses spiked 40% in the last 48 hours, while retail outflows dominate.

This pattern echoes past setups, 2024’s post-SEC lawsuit dip saw similar retail fear while institutions loaded, leading to a 300%+ rally in three months.

The current trigger? Broader macro jitters, think Fed pause talk, tariff threats.

But the buy signal is rare, and analysts say it’s a “hidden bullish divergence” on the weekly chart, where price makes lower lows but momentum (RSI, MACD) makes higher lows, textbook institutional entry zone.

XRP’s Institutional vs. Retail Divergence Patterns

We’ve seen this movie before. In 2023–2024, every major XRP dip (post-SEC clarity, ETF rumors) triggered retail FUD and sell-offs, only for institutions to quietly accumulate.

Data from Arkham and Nansen showed the same, retail wallets dumping while whale wallets grew 25–30% during fear phases.

The current setup mirrors that, XRP’s price action is detached from fundamentals. Macro adds fuel, if tariffs hit global trade, XRP’s use case as fast, cheap settlement could shine.

It’s not retail-driven anymore, it’s institutional chess while traders panic.

Retail Fear vs. Institutional Patience

This is classic market psychology in action. Retail reacts to headlines (price crash, case delays), while institutions look at long-term utility and valuation.

XRP trades at a steep discount to its 2018 highs despite massive adoption progress (RippleNet in 70+ countries, stablecoin launch, banking partnerships).

If institutions keep buying the dip, it likely creates a supply squeeze, retail sells low, whales load, price eventually snaps higher when sentiment flips.

The scale? Potential billions of buying pressure. TradFi has always played this game, buy fear, sell greed. Now it looks like crypto’s learning the same lesson.

So, if the buy signal holds and institutions keep loading, XRP could see a sharp reversal, historically these divergences resolve upward 70–80% of the time within 3–6 months.

Macro tailwinds, for example potential tariff chaos boosting cross-border need, add more fuel.

But experts say retail FUD can extend the dip, panic-selling creates more supply, and if macro worsens, even institutions pause.

There’s that saying, „no one wants to catch a falling knife”. Still, from retail fear to institutional accumulation is a flashing sign that XRP’s narrative is shifting from “lawsuit coin” to “institutional utility play.”

Yet Another Trap?

Some will call it institutional bag-holding, whales talking up their positions. Maybe there’s truth there, because yes, big players have incentives to accumulate quietly.

But the on-chain data doesn’t lie, bids stacking, whale wallets growing, retail dumping. The signal is real.

The point is that while traders panic-sell XRP, institutions are quietly buying the dip. If history repeats, this could be the setup for the next big leg up.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.