Bitcoin is sitting pretty around $104,000 after a wild sprint fueled by relentless buying and fresh waves of optimism.

The bulls? They stormed back in late April, snatching BTC from the jaws of a brutal sell-off that had the price stuck in a funk for months.

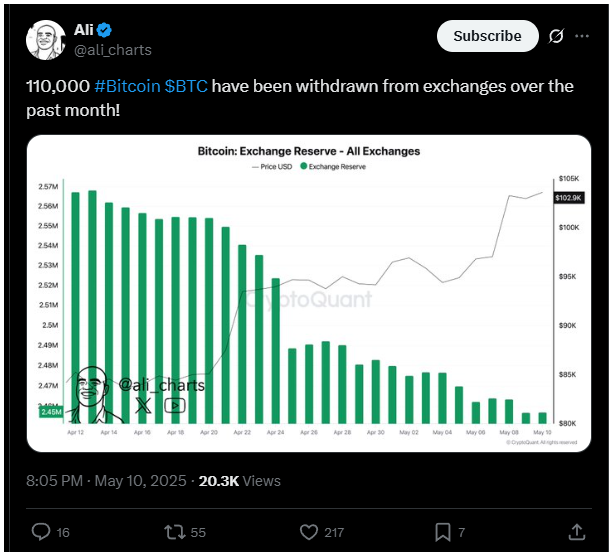

Exchange supply

CryptoQuant have spotted something juicy. Over 110,000 BTC have vanished from exchanges in just the past month.

Poof! Gone. Now, why does that matter? Because when Bitcoin leaves centralized exchanges en masse, it’s a classic sign investors are feeling confident and hoarding their coins away from the trading frenzy.

Less supply on the market means less selling pressure. And you know what that usually means? Prices get ready to rock.

Think about it like this, when the big players stash their Bitcoin in private wallets, they’re basically saying, not for sale, not today.

That’s the kind of behavior that sets the stage for a major rally. And with BTC hovering just shy of its all-time highs, the market’s hanging on every move, waiting to see if Bitcoin can bust through resistance around $105,000, a price point that’s been a thorn in its side for a while.

Moves

Now, $105K is like the final boss in a video game. Beat it, and Bitcoin’s off to new heights.

Fail, and we might see some profit-taking and a bit of a rollercoaster ride again before the bulls regroup. But the data’s on the bulls’ side.

Ali Martinez, a top analyst, points out that these massive withdrawals from exchanges aren’t just random, they’re a clear signal that long-term holders are stepping up, tightening the available supply, and getting ready for the next big move.

And it’s not just theory. Binance just saw a fresh wallet pull out 420 BTC right off the exchange.

That’s whale-level stuff, guys. When whales move like that, traders perk up. It’s a hint that the smart money’s gearing up for something big.

Crossroad

Technically speaking, in the time of writing Bitcoin’s chilling just below resistance at around $104,000 to $105,500, with short-term support near $103,600.

It’s like the calm before the storm. Volume’s dipped a bit, which is normal after a buying spree, but the bulls still hold the upper hand.

The 200-day moving averages are far below, showing the trend’s still bullish.

The good news is that experts say if Bitcoin breaks above this resistance cleanly, we’re looking at a straight shot to new all-time highs, maybe even well beyond $109,000.

But the bad news is if it stumbles, a quick retest of the $100K zone could be on the cards. Either way, the next few days are gonna be a nail-biter.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.