Rumors are flying about listing fees on major exchanges like Binance and Coinbase, and TRON founder Justin Sun is stepping in to clarify the situation.

What sparked the debate, what happened?

The drama kicked off when a venture capitalist shared some juicy details about a conversation with a high-profile project.

According to this source, the project received a listing offer that included the request for 15% of its total token supply, potentially worth up to $100 million!

This claim raised eyebrows, as many believe such hefty demands are why prices often dip after listings. They’re likely right, but we can’t know for sure yet, of course. It’s just speculation.

Coinbase CEO Brian Armstrong quickly jumped into the discussion, asserting that getting listed on Coinbase is free and inviting projects to apply directly.

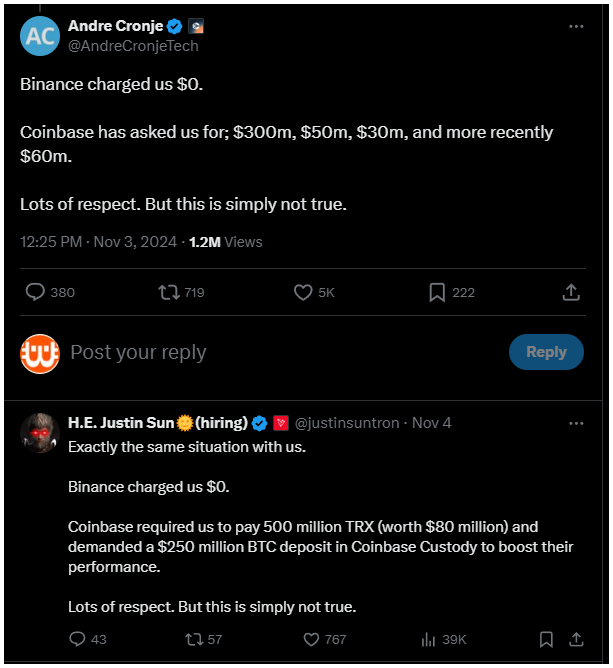

But not everyone was convinced. Andre Cronje, the founder of Fantom, countered Armstrong’s statement by revealing that Coinbase had previously asked Fantom for payments ranging from $30 million to $300 million over the years.

I don’t know about you, but we don’t call that free listing.

The Binance perspective

On the other hand, Cronje mentioned that Binance never charged Fantom for a listing, which contrasted with his experiences at Coinbase.

This perspective resonated with Justin Sun, who echoed similar frustrations regarding Coinbase.

Sun claimed that Coinbase demanded a significant amount of TRX tokens and even a $250 million Bitcoin deposit for performance purposes. He made it clear that Binance had never imposed such fees on TRON.

Binance responds

He Yi, co-founder and chief customer service officer at Binance, stepped up to clarify their listing process.

She stated that Binance has strict criteria for listings and that no amount of money or tokens can bypass their screening requirements.

Yi suggested that much of the speculation around Binance’s listing fees is simply unfounded and often stems from misunderstandings in the competitive sector of crypto exchanges.