The San Francisco-based Kraken exchange is making headlines as it reveals a 39% jump in regulatory and enforcement data requests in 2024.

In their latest transparency report they mentioned that the exchange received 6,826 requests from authorities across 71 countries.

Give me your data

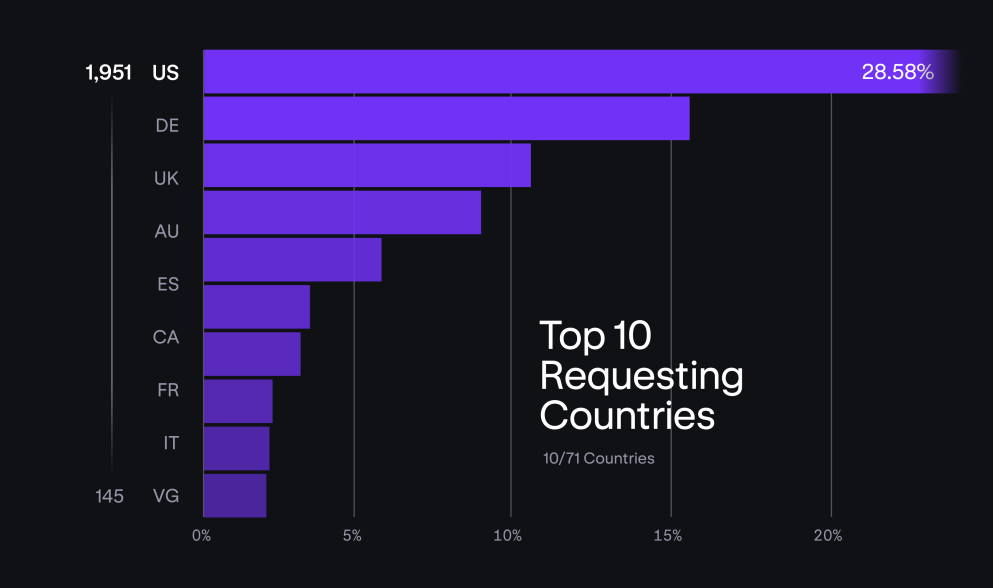

So, who’s been knocking on Kraken’s door? Well, the United States is leading the pack, accounting for the lion’s share of inquiries, 1,951 to be exact.

The FBI is at the forefront, issuing 614 requests, which makes up about 31% of all U.S. requests.

The SEC only contributed a tiny 1.9% of total U.S. requests but still made a quite significant impact with 37% of all regulatory inquiries.

Now, let’s get into the nitty-gritty. Kraken reported that they provided data for 57% of these requests, which involved digging into 10,369 accounts. Most of these inquiries came from clients in the U.S., the U.K., and Germany.

Kraken reassured everyone that they have strict policies in place to comply with legal requirements while also protecting client privacy.

For our safety

While it might sound alarming that so many agencies are asking for data, Kraken emphasized that this is part of their commitment to transparency and compliance.

“Consistent disclosure of compliance information demonstrates our longtime commitment to complying with legal and regulatory requests.”

They’re all about financial freedom and global crypto adoption while keeping an eye on regulations.

But it’s not just U.S. agencies making claims, as countries like Germany, Australia, Spain, Canada, and France are also among the top requesters of data from Kraken.

Payday

In other exciting news for Kraken, they recently announced that they raked in $1.5 billion in revenue for 2024, 128% increase from the previous year.

With all this attention from regulators and a booming business model, it looks like Kraken isn’t slowing down solidifying its place as a major player in the crypto exchange game.

Have you read it yet? Litecoin transactions rise 243% amid ETF hype

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.