You wake up, check your wallet, and your OM tokens have tanked over 90% overnight. Ho li fuk.

That’s what happened to holders of Mantra’s OM token, and let me tell you, the fallout’s got more drama than a family dinner gone wrong.

Play stupid games…

John Mullin, Mantra’s big boss, isn’t sugarcoating it. He says this disaster is bigger than Mantra.

The culprit, according to Mullin, is the reckless leverage policies on big-name crypto exchanges.

You let traders pile on risky bets, and when things go sideways, you get a liquidation cascade, one forced sale triggers another, and the whole thing snowballs until your token’s worth less than a cup of coffee.

Now, Mullin’s not just pointing fingers. He’s calling for the whole industry to get its act together.

We’re working with exchanges, but everyone needs to pitch in, he says. Translation, if you let people gamble with dynamite, don’t be shocked when something blows up.

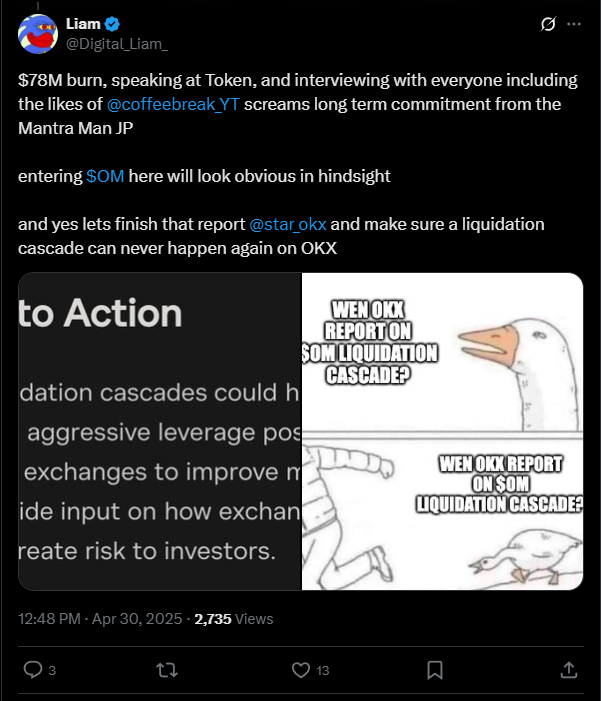

But none of the exchanges want to talk about it. OKX, rumored to be in the thick of it, won’t even return a phone call.

Meanwhile, their CEO called the OM crash a big scandal for the whole industry, then zipped his lips.

Recovery

So, what’s Mantra doing to clean up the mess? For starters, they’re burning 150 million staked OM tokens to shrink supply and maybe pump up the price a little.

They’re also slashing their own internal validators by half and bringing in 50 new external partners, all in the name of decentralization and trust.

And if you’re into dashboards, they’ve rolled out a real-time tokenomics tracker so you can watch the numbers dance in real time.

Transparency? They’re doubling down. Mullin’s out there promising to share on-chain data, host community chats, and publish the nitty-gritty on what went down.

They’re even testing a new EVM-compatible testnet, Omstead, hoping to beef up the tech so this kind of chaos doesn’t happen again.

Risk

But the OM token’s still licking its wounds, trading way below its old highs. Mullin says the road to recovery will be slow, and he’s not making any wild promises.

The team’s even burning their own tokens to prove they’re in it for the long haul, not a quick buck.

Either way, this crash is a wake-up call for the whole crypto industry. If exchanges keep letting traders play with fire, don’t act surprised when the house burns down.

It’s a big scandal to the whole crypto industry. All of the onchain unlock and deposit data is public, all major exchanges’ collateral and liquidation data can be investigated. OKX will make all of the reports ready! https://t.co/YYnb1ByUGL

— Star (@star_okx) April 14, 2025

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.