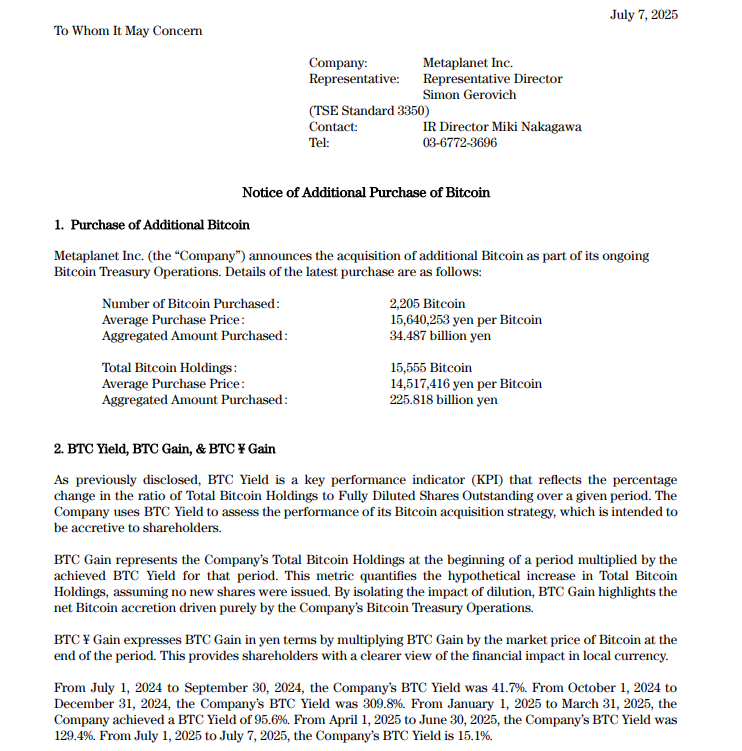

Metaplanet has acquired 2,204 Bitcoin for approximately $237 million, according to a filing published on Monday.

The purchase was made at an average price of 15,640,253 Japanese yen per BTC, equal to about $107,700 in U.S. dollars.

With this addition, Metaplanet Bitcoin holdings now stand at 15,555 BTC. The company’s average purchase price across all its Bitcoin is around $99,985 per BTC.

This latest transaction follows a series of acquisitions by Metaplanet in June, which significantly expanded its Bitcoin position.

Metaplanet Overtakes Tesla in Bitcoin Holdings

The updated balance moves Metaplanet past both Tesla and CleanSpark in the corporate Bitcoin rankings.

Tesla holds 11,509 BTC, while Bitcoin miner CleanSpark owns 12,502 BTC, based on data from BitcoinTreasuries.NET.

In late June, Metaplanet disclosed two separate acquisitions. On June 30, the company reported a purchase of 1,005 BTC worth $108 million. Earlier that month, it acquired 1,234 BTC, pushing total holdings to 12,345 BTC, just above Tesla.

The Monday filing confirms that Metaplanet now ranks as the fifth-largest corporate Bitcoin holder, following companies like MicroStrategy and Block.

BTC Treasury Companies Expand Holdings in Late June

Other BTC treasury companies also increased their Bitcoin holdings in late June.

MicroStrategy, the largest corporate Bitcoin holder, announced a 4,980 BTC acquisition for $531.1 million on June 30.

That purchase brought its total to 597,325 BTC, bought at an average of $70,982 per BTC.

Crypto investment firm ProCap, founded by Anthony Pompliano, entered the space with a 3,724 BTC purchase valued at $386 million.

In the same period, Semler Scientific, a healthcare technology company, disclosed plans to expand its Bitcoin holdings from 3,808 BTC to 105,000 BTC.

These acquisitions reflect a broader pattern among BTC treasury companies, as multiple firms moved to increase their Bitcoin reserves.

Glassnode Analyst Questions Long-Term Treasury Trend

While corporate Bitcoin purchases continue, some market analysts have raised concerns.

James Check, lead analyst at Glassnode, commented on July 6 that future returns for new corporate entrants may be limited.

“For many new entrants, it could already be over,” Check said. He explained that investor attention may favor earlier adopters.

“Nobody wants the 50th Treasury company,” he added, referring to newer firms joining the list of corporate Bitcoin holders.

A separate report by Breed, a venture capital firm, suggested that most BTC treasury companies could struggle to maintain their positions. The report stated that only a few will likely avoid entering a “death spiral.”

Metaplanet Bitcoin Holdings Now Tracked at 15,555 BTC

According to BitcoinTreasuries.NET, Metaplanet’s Bitcoin reserves place it fifth among all public corporate Bitcoin holders. The ranking includes data from public disclosures and filings.

The site tracks companies that add Bitcoin to their balance sheets. The latest update reflects the growing number of firms adopting BTC as a treasury asset.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.