Morgan Stanley may gain an “intangible benefit” from its spot Bitcoin ETF, even if the fund stays small, according to Jeff Park, chief investment officer at ProCap.

Park spoke on Wednesday, one day after the Morgan Stanley SEC filing that outlined two proposed crypto ETFs. One product tracks Bitcoin, while the other tracks Solana.

The filings put the Morgan Stanley Bitcoin ETF plan in front of U.S. regulators at a time when large asset managers compete for crypto ETF market share.

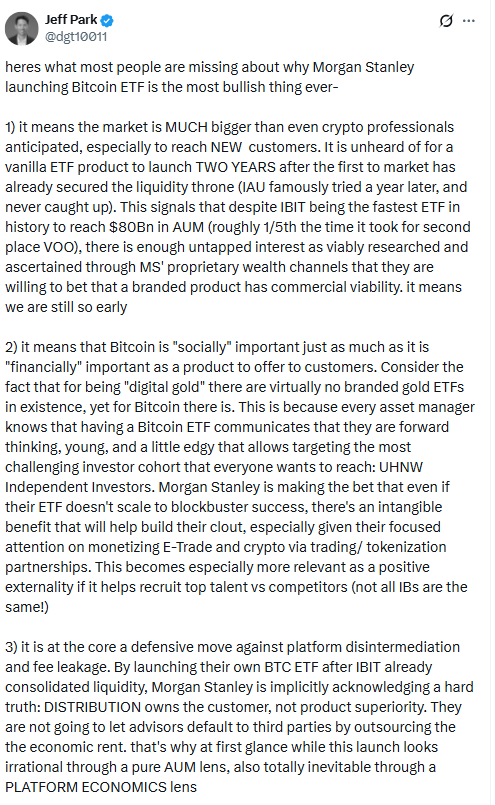

Morgan Stanley Bitcoin ETF seen as strategy beyond inflows

Jeff Park said the Morgan Stanley Bitcoin ETF move matters even if flows disappoint.

“Morgan Stanley is making the bet that even if their ETF doesn’t scale to blockbuster success, there’s an intangible benefit that will help build their clout,”

Park said.

Park tied that “intangible benefit” to social, reputational, and financial effects. He said those effects can show up across the business, not only inside the spot Bitcoin ETF vehicle.

Park also linked the spot Bitcoin ETF decision to hiring. “This becomes especially more relevant as a positive externality if it helps recruit top talent vs competitors,” he said.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

ETRADE crypto trading and tokenization partnerships in focus

Park pointed to ETRADE as a key part of the wider plan. He said Morgan Stanley has shown “focused attention” on monetizing ETRADE through ETRADE crypto trading and tokenization partnerships.

That framing places the Morgan Stanley Bitcoin ETF inside a broader push. It also connects the proposed ETF lineup to a pipeline of crypto services aimed at brokerage users.

Park said the crypto market looks larger than many expected. He added that size matters most when firms try to reach new customers through familiar platforms.

Morningstar and Reuters highlight ETF market impact

A separate view came from Bryan Armour, a Morningstar ETF analyst, in comments reported by Reuters on Tuesday.

Armour said Morgan Stanley’s entry could help it redirect existing Bitcoin investors into its own funds.

Armour told Reuters that Morgan Stanley may want to “move clients that invest in Bitcoin into their ETFs, which could give them a fast start despite their late entrance.” His comment focused on client migration, not only new demand.

Armour also described a legitimacy effect tied to large financial brands. “A bank entering the crypto ETF market adds legitimacy to it, and others could follow,” he said.

Morgan Stanley is widely ranked among the world’s top investment banks, alongside Goldman Sachs and JPMorgan.

The Morgan Stanley Bitcoin ETF filing adds another example of banks using regulated products to expand crypto exposure.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 8, 2026 • 🕓 Last updated: January 8, 2026