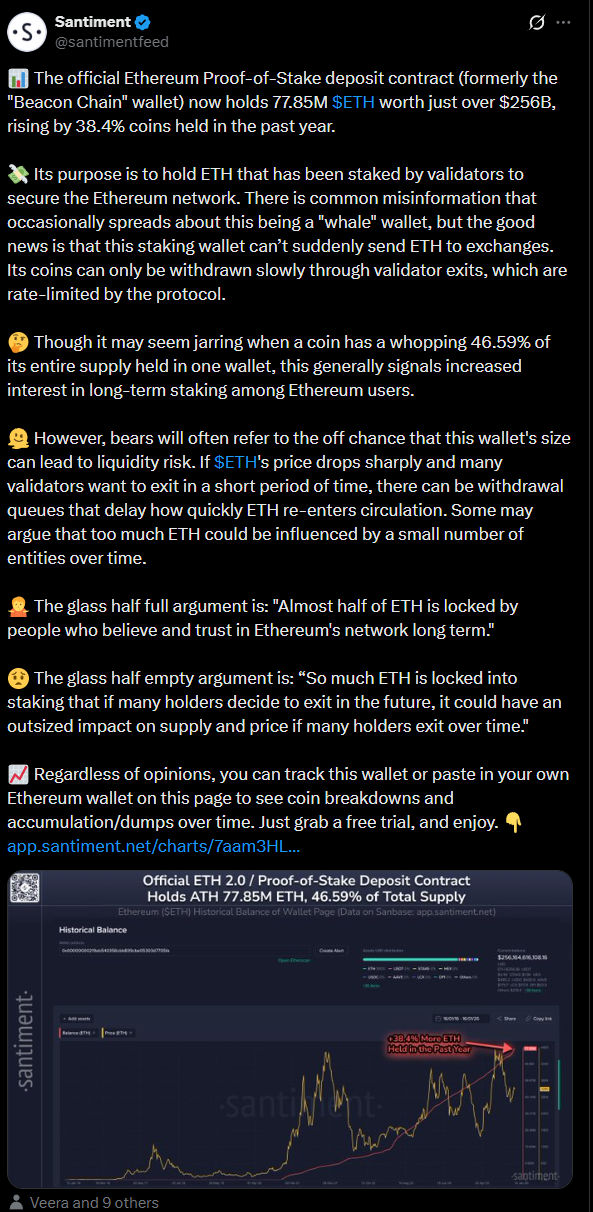

Ethereum staking just hit a huge milestone. Santiment reports nearly 47% of all ETH, that’s 77.85 million coins worth over $256 billion, sitting pretty in the proof-of-stake deposit contract.

Validators and big players keep piling in, locking up supply like it’s going out of style.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Why Ethereum Staking Matters in the Big Picture

Honestly, this isn’t some random crypto quirk. Staking is viewed by many as a security mechanism, so it’s actually a full-on commitment to Ethereum’s future.

Think back to Bitcoin’s early days when miners locked hardware for rewards, or how gold bugs stash bars in vaults for the long haul, now staking does that for ETH, securing the network while holders earn yields around 3-5% annually.

Last year alone, staked ETH jumped 38.4%, outpacing even the hottest ETF inflows.

It shows holders betting big on Ethereum outlasting market hiccups, much like how institutional bond buying stabilized Treasuries during 2022’s chaos.

Why care? Locked supply tightens liquidity, potentially juicing prices when demand spikes. Translation? Ethereum supply squeze may coming.

The Lock-Up Frenzy: Validators and Institutions Pile On

Retail people and suits alike are diving headfirst into Ethereum staking. On-chain data paints a clear picture, the deposit contract, once called the Beacon Chain wallet, gobbles up ETH to power validators who keep the blockchain humming.

No whale games here, funds can’t zip straight to exchanges. Withdrawals? Only when validators bail, and even then, the protocol throttles the floodgates to avoid chaos.

Institutions crank up the heat, and funds, custodians, ETF services have staked over 10 million ETH.

BitMine Immersion Technologies leads the pack with 1.25 million ETH locked, flexing real muscle.

Lido Finance? They’re bossing 24% of all staked ETH, turning into the ecosystem’s undisputed champ.

Risks in the Staking Pool, Don’t Forget Liquidity Jitters and Power Plays

Sure, it’s a vote of confidence, nearly half of ETH committed long-term for those sweet rewards.

But picture a less-optimistic script, when markets tank, validators panic-sell, and withdrawal queues stretch like a bad hangover line.

Analysts say that could drag ETH’s return to circulation, whipping up wild price swings.

Critics mutter about big holders gaining too much sway, concentrating power in fewer hands. Still, Ethereum’s stability is impressive.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: January 19, 2026 • 🕓 Last updated: January 19, 2026

✉️ Contact: [email protected]