Bitcoin is officially going mainstream, and it’s not just a passing trend. A new research reveals that 1,573 financial institutions have jumped on the Bitcoin bandwagon as of the end of 2024.

They’re interested?

Sam Callahan, a Bitcoin analyst and educator, did some serious digging into the U.S. Securities and Exchange Commission’s 13F filings.

These forms are submitted quarterly by large investment firms to disclose their holdings in stocks and equity-related assets. And guess what?

This includes a mix of banks, hedge funds, family offices, endowments, pensions, and other asset managers.

While these filings show that institutions are interested in Bitcoin, they only cover long positions in U.S. equity-related assets.

That means they don’t account for bonds, real estate, commodities, venture capital, futures, or even spot Bitcoin ETFs. So basically, we’re only seeing part of the picture here.

Gradually, then suddenly?

The median Bitcoin position across these institutions is a mere 0.13%. This suggests that while interest is growing, we’re still in the early days of institutional adoption.

Horizon Kinetics has a hefty $1.3 billion exposure to Bitcoin, that’s about 16% of their portfolio, while Bracebridge Capital has $334 million, or around 24%.

Tudor Investment Corp and Brevan Howard are also in the game with significant allocations.

Interestingly, large quant firms like Millennium and Jane Street hold Bitcoin ETFs primarily for arbitrage opportunities rather than long-term investments.

Big banks like JPMorgan and Goldman Sachs have small holdings in Bitcoin ETFs mostly for market-making purposes due to regulatory restrictions.

Early days, golden opportunity?

Overall, it’s clear that Bitcoin is gaining traction as an institutional asset, but we’re still just scratching the surface.

Only 19% of the 8,190 13F filings from last quarter reported any BTC exposure. Callahan thinks the big money didn’t decide yet.

“Institutional investors managing trillions of dollars are still just dipping their toes in this market.”

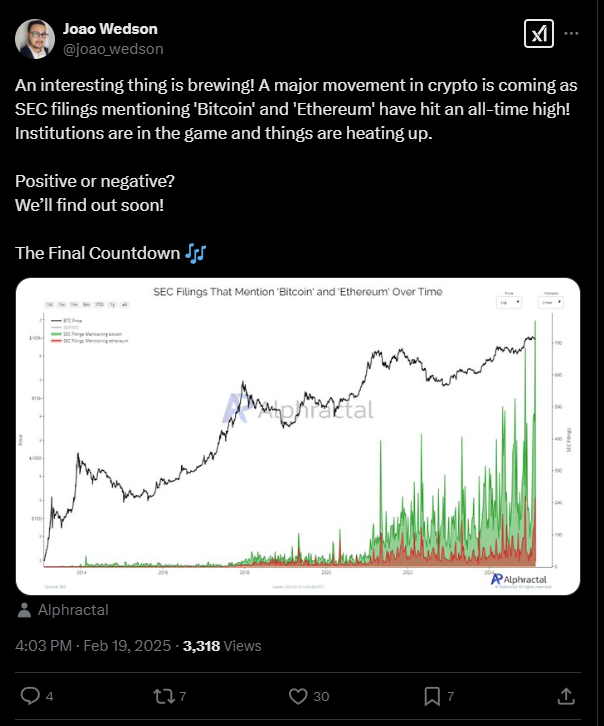

And here’s some exciting news, because on February 19, Joao Wedson from Alphractal pointed out that SEC filings mentioning Bitcoin and Ethereum have hit an all-time high,

This could means that institutions are seriously getting involved in crypto as things heat up.

Have you read it yet? Microsoft quantum-chip sparks Bitcoin doomsday debate

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.