Paradigm research claims that Polymarket trading volume reported on major dashboards is inflated by a Polymarket data bug.

Researcher Storm from Paradigm said the issue is not about wash trading. Instead, it comes from how onchain data is recorded and later interpreted by analytics platforms.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Storm stated that

“almost every major dashboard has been double-counting Polymarket volume not related to wash trading.”

This means some headline Polymarket trading volume figures do not match the actual economic activity on the protocol. The problem appears in how events from Polymarket smart contracts are aggregated.

According to Storm,

“Polymarket’s onchain data contains redundant representations of each trade.”

When analytics teams read this data, they often sum all the events together. As a result, the Polymarket data bug leads to double-counted volume across widely used dashboards that track prediction markets.

How Polymarket Data Bug Creates Double-Counted Volume

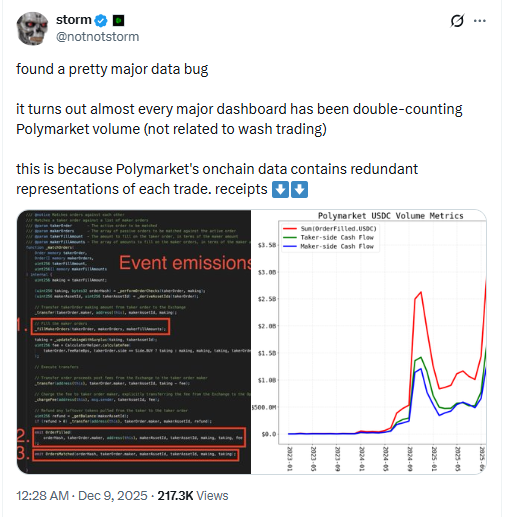

The Polymarket data bug arises from the way the protocol logs each trade onchain. When a trade happens, Polymarket emits multiple “OrderFilled” events.

One set records the trade for the maker, who placed an existing order. Another set records it for the taker, who accepts and fills that order.

These maker and taker OrderFilled events describe the same transaction from two sides. However, according to the Paradigm research, many dashboards treat them as separate trades.

When they compute Polymarket trading volume, they add both sets together.

This approach creates double-counted volume for the same activity.

Storm said

“Polymarket’s onchain data is quite complex, and this has led to widespread adoption of flawed accounting methods.”

The researcher argued that standard blockchain explorers do not give enough structure to distinguish which events belong to one underlying trade.

As a result, common query patterns in dashboards fail to remove the redundancies built into the protocol’s design.

Complex Polymarket Trading Volume Metrics And Contract Design

The Paradigm research also said the Polymarket data bug affects both key prediction market metrics: notional volume and cashflow volume. Notional volume reflects the total face value of contracts traded.

Cashflow volume reflects the actual money entering or leaving positions. With double-counted volume, both measures show numbers above the real activity.

Storm noted that

“Polymarket’s data has been notoriously confusing for crypto data analysts … the data has too many layers of interacting complexity to untangle using just a block explorer.”

On Polymarket, trades can be simple swaps. They can also be “splits” and “merges,” where both counterparties exchange cash for opposing outcome tokens in one transaction.

Because of this structure, the smart contracts emit several tracking events for the same operation.

Those events help Polymarket manage internal accounting. Yet standard explorers and indexing tools do not clearly display which events are duplicates for volume purposes.

This gap between contract design and analytics practice sits at the center of the Polymarket data bug highlighted in the Paradigm research.

Polymarket Trading Volume Figures And Valuations Questioned

The Polymarket trading volume numbers feed directly into how the platform is valued. The Intercontinental Exchange (ICE) recently valued Polymarket at $9 billion, citing around $25 billion in trading volume.

If double-counted volume is present in those totals, some inputs behind that $9 billion figure may be overstated.

Earlier, reports in September said Polymarket was preparing for a United States launch at a $10 billion valuation.

In October, Bloomberg reported that the platform was seeking to raise funds at a valuation between $12 billion and $15 billion.

All of these numbers were discussed in an environment where analytics dashboards were widely quoting large Polymarket trading volume metrics.

Dashboard providers named in the Paradigm research include DefiLlama, Allium, Blockworks, and multiple Dune Analytics.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 9, 2025 • 🕓 Last updated: December 9, 2025