As August came to a close, PEPE experienced a sell-off, and if this isn’t enough, the overall outlook based on network metrics wasn’t very promising either.

Trend shift, or the end of the party?

PEPE was trading within a bullish flag on longer timeframes, what’s considered as a period of consolidation.

The downward momentum slowed, but it hadn’t yet been replaced by an uptrend, especially on the daily chart.

In shorter time-frema, on the 4-hour chart, there was some hope that momentum might soon turn bullish, and for this, stronger buying pressure was needed. But it didn’t come.

Analysts now thinking about what could come next for PEPE. Some experts warn this may signal the overall weakening of the memecoin hype, but others think it’s far from over.

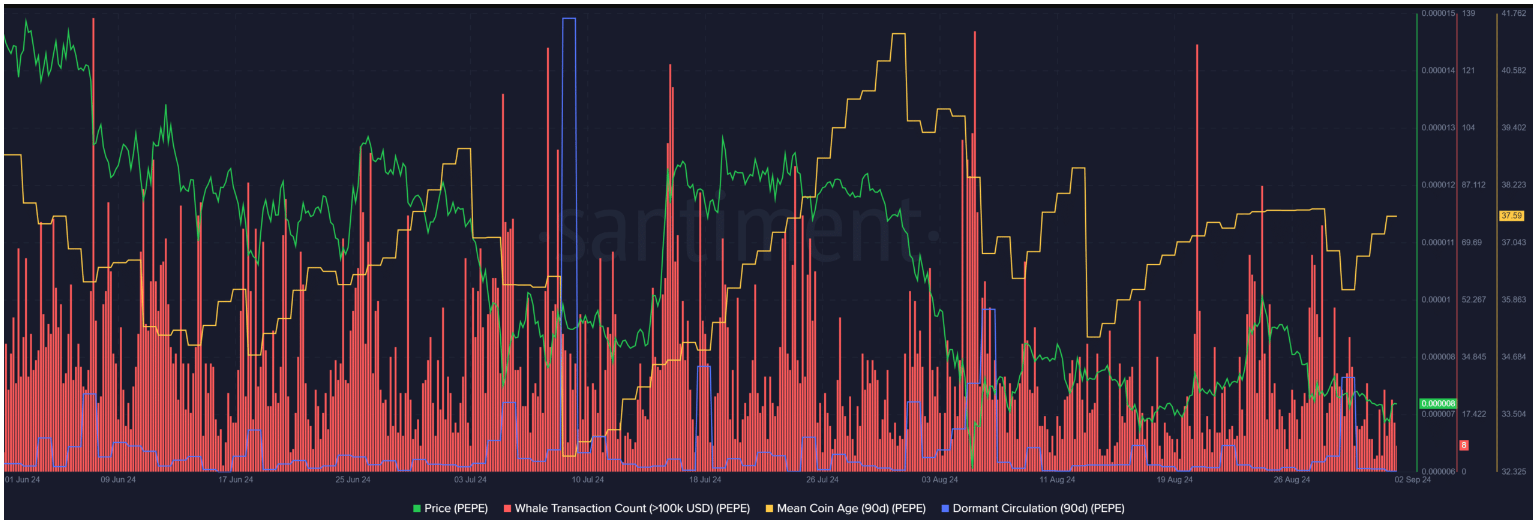

The activity of PEPE whales usually appears to be panic-like.

In late July, the average age of coins in the network was rising, signaling accumulation across the network.

During this period, transactions involving large PEPE holders, or whales, increased, hinting at potential accumulation.

But on August 5th, a quite big price drop was accompanied by a spike in whale transactions, and many think this was panic selling.

A similar but smaller pattern occurred on August 28th and 29th too, with the average coin age decreasing and whale activity increasing.

This was further confirmed by a surge in dormant coins moving on August 30th, signaling another wave of selling. And when whales selling en masse, it’s not a good sign.

Network activity tanked

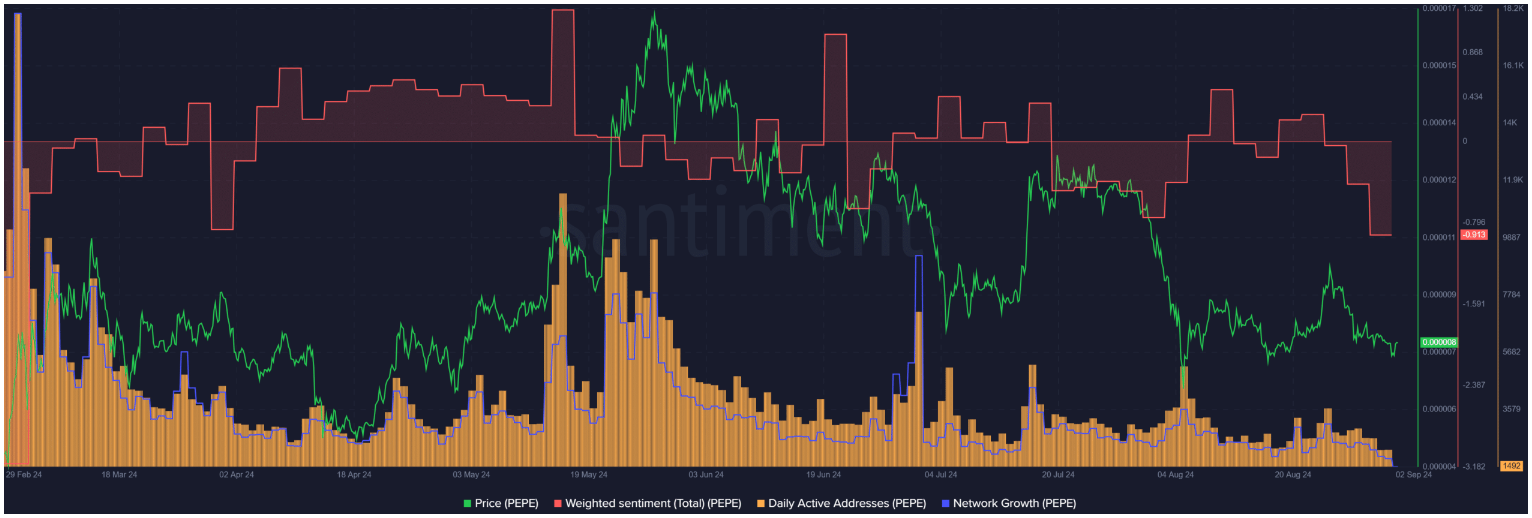

Investors might hope that the selling wave is the last for now. Even if PEPE’s price stabilizes around the $0.0000071 support level, the network’s activity remains concerning.

Both daily active addresses and the network’s growth metric declined over the past week, the coin’s price too, which means less market participation and decreasing adoption of PEPE.

The sentiment around PEPE has also turned negative, as reflected by a drop in weighted sentiment, which tracks online engagement.

For memecoins, the hype and the engagement is everything, and now the future seems less bright.