The major player in the Bitcoin mining scene reported a nice 65% increase in revenue compared to last year.

But not everything is fun and games, the company is facing some bumps in the road when it comes to its hashrate expansion plans.

Revenue growth

CEO Jason Les shared that Riot generated $84.8 million in revenue this quarter, marking a big jump from the same period in 2023.

Thanks to a boost in deployed hashrate, the company managed to produce 1,104 Bitcoin during the quarter, which is consistent with its production levels from Q3 2023, even with the recent halving.

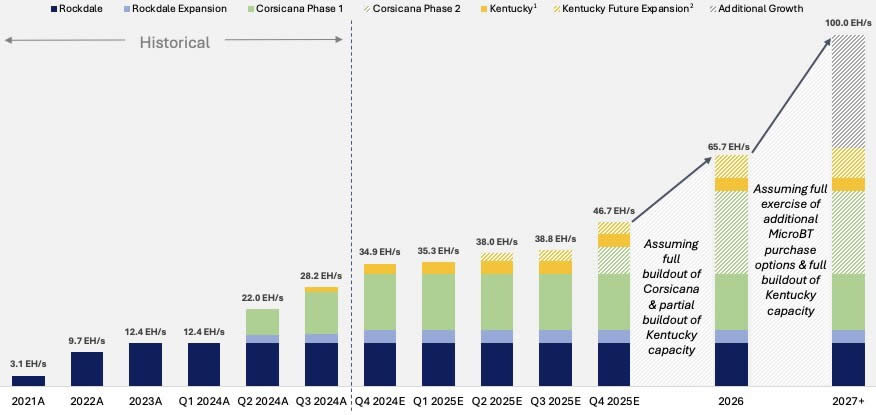

Les noted that Riot achieved impressive growth during the first full quarter after the Bitcoin halving, driven by a 159% year-over-year increase in deployed hashrate, reaching 28 EH/s by the end of September.

But again, it’s not all sunshine and rainbows. The company reported a net loss of $154 million for the quarter, which translates to $0.54 per share.

This loss is a painful 92% increase compared to Q3 2023, primarily due to reduced power credits and rising operating expenses.

Mining costs and financial strength

The average cost to mine one Bitcoin stood at $35,376, which is about half of the current market price hovering around $72,000.

Les attributed this efficiency to their energy practices, boasting an industry-leading average power cost of just 3.1 cents per kilowatt-hour.

While Les expressed enthusiasm for Riot’s future plans, highlighting efforts to ramp up power capacity and hashrate across Texas and Kentucky, as there are some adjustments to their hashrate projections.

The company now expects to reach 34.9 EH/s by the end of 2024, down from an earlier target of 36.3 EH/s due to slower-than-expected expansion at their new Kentucky facility.

More hashrate, but what about the stock price?

Looking ahead, Riot anticipates ending 2025 with a hashrate of 46.7 EH/s, which is also lower than their previous estimate of 56.6 EH/s. Lower, but still nice.

This change is attributed to expansion delays and longer lead times for additional infrastructure at their Corsicana facility.

Once both facilities are fully operational, Riot expects to hit a capacity of 65.7 EH/s by the end of 2026.

After these announcements, Riot’s stock dipped by 3.6%, trading at $9.86 in after-hours trading on October 30.

Year-to-date, shares are down 32% and have plummeted 85% since reaching an all-time high of just over $70 back in February 2021.