Imagine stepping into a time machine, dialing it back six years, and plunking down $4,000 on Bitcoin. Now that’s the vintage move Robert Kiyosaki wants you to channel.

The Rich Dad, Poor Dad guru, part economics sage, part crypto evangelist, insists that scooping up Ethereum at $4K today is basically déjà vu for the Bitcoin bucks game of yesteryear.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Fiat is failing?

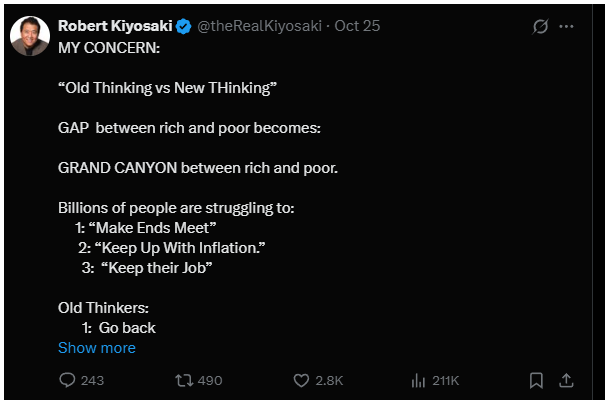

Kiyosaki’s X feed lit up with a simple yet bold proclamation:

“People who acquire ETHEREUM today @ $4000 will be like the rich who invested in Bitcoin when it was $4000.”

The man has been forecasting wild economic chaos ahead, fueled by the failing fiat currency circus.

So, his crypto love story isn’t just hype, it’s basically a hedge against the financial apocalypse.

It’s nothing more than ptimistic storytelling?

But hold your horses before buying in like it’s a nostalgic crypto garage sale. Here’s the catch, comparing Ethereum at $4K to Bitcoin at the same price is more complex than saying “they’re twins.”

Bitcoin’s supply is a tight-knit 19.94 million coins, with a 21 million hard cap, while Ethereum floats around over 120 million, and it’s unlimited.

Do the math and buying ETH at $4K equates, against market cap, to snagging Bitcoin at roughly $24K.

So the “same-buy” story? Let’s call it optimistic storytelling with a dash of crypto poetic license.

Still, Kiyosaki banks on Ethereum’s smorgasbord of real-world apps and envisions it stealing the Bitcoin crown someday, despite the crypto crowd mostly sticking with their OG digital gold.

The past few years have beaten Ethereum a bit, especially in a bull market where BTC flexes harder, but the programmable blockchain world still buzzes with promise.

Digital gold rush

Ethereum flirted with a sweet $4.9K ATH back in August but has been cooling off since, chilling near $4K after a bearish October tantrum.

Just last year, ETH was chilling at $1.5K, so a 230% jump still makes Moon Bros cheer.

Whether it’s too hot to handle or just heating up is anyone’s guess, but Kiyosaki and various analysts aren’t sweating it.

They see programmable chains like Ethereum as early disruptors trying to rewrite the global financial script.

So, is blowing $4K on ETH a genius call or a crypto crush waiting to happen? For Kiyosaki’s followers, it’s déjà-vu in the making, another chance at a digital gold rush.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 28, 2025 • 🕓 Last updated: October 28, 2025

✉️ Contact: [email protected]