In a crypto drama that practically writes itself, Bitcoin tumbled under $94,000 on Friday, hitting a six-month low and stirring the usual panic.

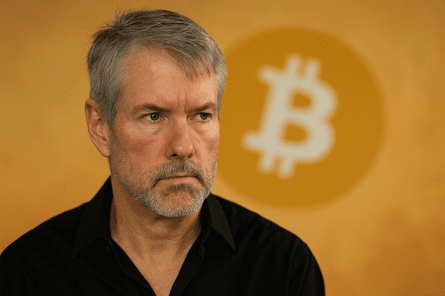

Rumors swirled like a caffeinated cyclone that Michael Saylor and his company, Strategy, were selling off their enormous BTC stash. But Saylor is having none of it.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Buying even harder

The whispers started from some small accounts with questionable credibility but quickly morphed into a wildfire picked up by influencers with half a million followers or more on X.

Chaos ensued, some cried “sell-off apocalypse,” but many in the crypto trenches stayed cool, trusting Saylor’s legendary HODL game.

In a move that didn’t just deny but flipped the script, Saylor took to X and CNBC to declare Strategy was buying Bitcoin every single day this week, doubling down while others fled.

Volatility? Comes with the territory, he said, reminding everybody that anyone betting on Bitcoin is buckled in for a rollercoaster.

No forced sales

He advised the brave to focus on the longer haul, a sprawling four-year horizon where BTC outshines every other asset class on Earth.

So, Saylor said Strategy isn’t sweating any forced sales, an 80% price drop wouldn’t shake them.

With 641,692 BTC currently on hand, worth nearly $62 billion, experts agree they’re not in the panic-selling business.

True bulls don’t run

Arkham Intelligence got tangled in the rumor web, suggesting Strategy dumped coins.

Arkham promptly set the record straight, those weren’t sales but routine wallet shuffles, moving 43,415 BTC across 100+ addresses from Coinbase Custody to a new custodian.

They reassured everyone that this kind of wallet rotation is normal and ongoing.

So there you have it. While Bitcoin’s crazy ride continues, Michael Saylor and Strategy remain unflinching.

The takeaway? In the eye of the storm, true bulls don’t run, they buy more Bitcoin.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: November 16, 2025 • 🕓 Last updated: November 16, 2025

✉️ Contact: [email protected]