In-kind redemption is here. The US Securities and Exchange Commission approved a savvy move letting crypto ETFs ditch the cash-only routine and offer in-kind redemptions.

Translation? Now, authorized players can snag the actual underlying crypto instead of getting paid in cold, hard cash.

Direct swap of the assets

How was it before? Imagine you’re at the office break room, and every time you wanted a slice of pizza, you had to wait for the cashier to count your cash, find change, and then finally hand you a slice.

Slow, right? That’s how crypto ETFs operated till now, slow cash transactions every single time someone wanted to jump in or out.

But now? Bam! A direct swap of the asset for the shares, just like your regular stock ETFs have always done.

You see, this in-kind redemption model is an old trick from traditional ETFs for stocks and commodities.

It cuts the friction, giving fund issuers and market makers more room to maneuver, making the whole game smoother and cheaper.

And by letting investors take their crypto in-kind, the SEC just handed them a neat tax advantage on a silver platter. Wanna avoid triggering capital gains tax every time you redeem?

Now you can. Instead of the ETF having to sell crypto to pay you in cash, often causing taxable events, investors get the actual coins, deferring taxes until they decide to sell themselves. It’s like having your cannoli and eating it too.

New options

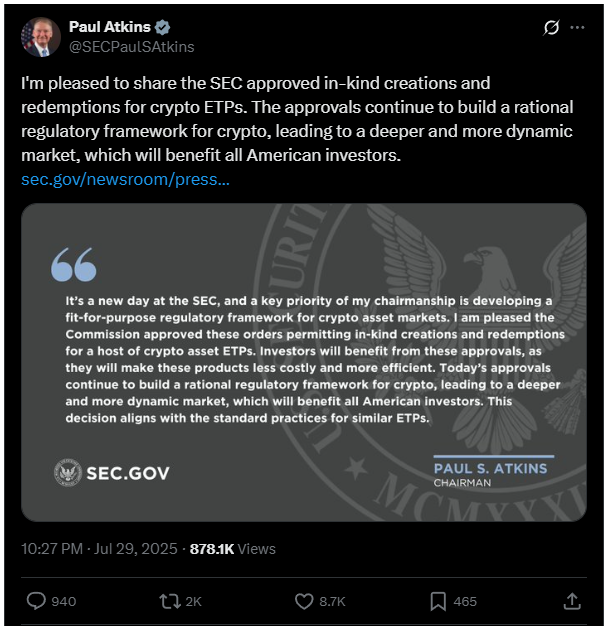

Chairman Paul S. Atkins even laid down the line, saying this move fits his fit-for-purpose regulatory framework vision, meaning the SEC’s aiming to make the crypto market both efficient and investor-friendly.

It’s a signal that the crypto sector is shaking off someold chains, moving closer to how mainstream ETFs have operated for years. And let me tell you, that’s good news for everyone at the table.

But the SEC didn’t stop there, no, no, no. They also greenlit some slick new plays, like listing a mixed Bitcoin and Ether spot ETP, plus options and Flexible Exchange options on certain Bitcoin products.

Position limits for these options got bumped up to 250,000 contracts, aligning crypto ETFs with traditional market standards. It’s like giving the crypto players a VIP pass to the big leagues.

Better liquidity

Look, since spot Bitcoin ETFs debuted, crypto ETF assets have been rocketing up, amassing tens of billions in assets under management.

And this regulatory upgrade could supercharge that growth. No more clunky cash dealings slowing trades down.

We’re talking better liquidity, tighter spreads, and a magnet pulling cautious institutional investors into the cryptosphere.

It’s the kind of change that turns crypto ETF from a niche novelty into a major market player.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.