Celsius announced its second round of payments to creditors as it continues to navigate its bankruptcy proceedings.

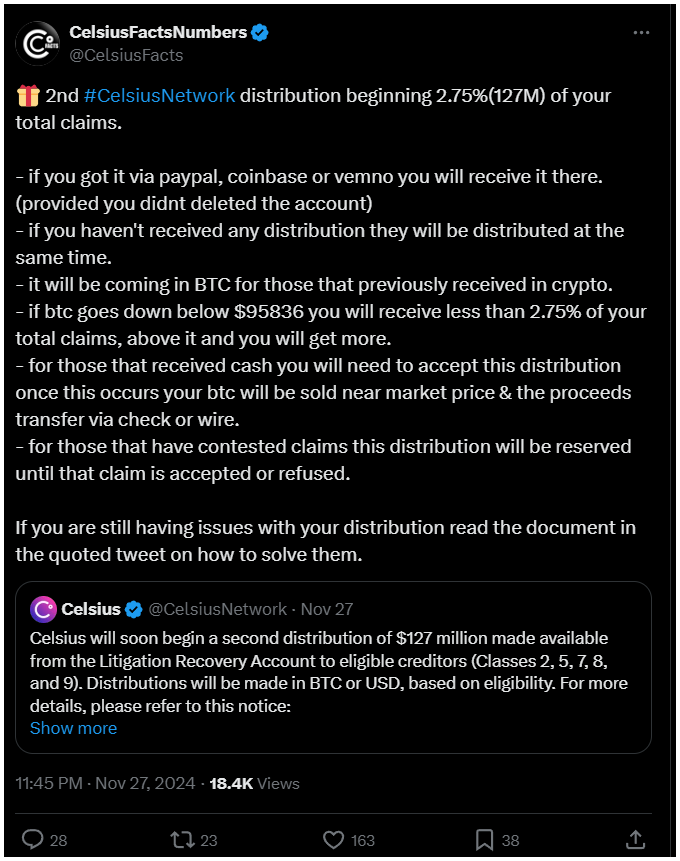

This time, they’re dishing out $127 million in assets, which will cover about 2.75% of total claims.

Self custody is sooo dangerous, oh wait

This payout follows an earlier distribution in August that returned $2.53 billion to around 251,000 creditors, that’s about 57.65% of their claims!

With this new round of payments, the total amount returned to creditors now sits at 60.4% of eligible claims.

So, it’s looking like creditors are finally seeing some light at the end of the tunnel!

“As a result of the Second Distribution, each Eligible Creditor will receive a cumulative distribution in Cash or Liquid Cryptocurrency equal to approximately 60.4% of the value of such creditor’s Claims as of the Petition Date.”

How will payments work?

Creditors will receive their funds in either Bitcoin or cash, depending on their eligibility.

If you got crypto payments before, you’ll keep getting Bitcoin, and cash recipients will also be paid in cash.

To keep things smooth and simple, Celsius plans to use the same distribution agents as before whenever possible, but here’s a catch.

If you want your Bitcoin payment, you need to have a verified Coinbase account linked to your Celsius records.

Celsius warned that after November 9, 2024, any non-corporate creditors who haven’t received their distributions via Coinbase will automatically be switched to a U.S. dollar payout instead.

The Bitcoin factor

Now, here’s where it gets more interesting, because the amount creditors receive in Bitcoin will depend on its market price.

If Bitcoin dips below $95,836, some creditors might end up with less than that 2.75% payout. But if Bitcoin’s price rises?

Well, that could mean bigger payouts for everyone! A Celsius-focused account on X clarified that for those who can’t accept crypto, their Bitcoin equivalent will be sold at market rates, and they’ll get the proceeds in U.S. dollars through various methods like wire transfers, PayPal, or Venmo.

Former Celsius CEO Alex Mashinsky is also gearing up for his trial on January 28, 2025, with a pre-trial hearing scheduled for January 16.

Not so long ago a federal court denied his request to dismiss fraud charges related to the company’s downfall.