SEI’s been crawling in the shadows for months, stuck in a downtrend. It’s the crypto market’s sad office worker waiting for Friday.

But now? Bam! The numbers are lighting up like the break room coffee machine on Monday morning.

Skyrocketing numbers

Daily Active Wallets jumped over 10% to a solid 561,000, and Daily Transactions? They jumped 20%, hitting 1.47 million.

This is a full-on adoption wave, guys, and it’s gaining steam fast, pushing SEI’s price to around $0.30. Now, SEI’s social chatter is buzzing louder than a water cooler gossip session.

Analysts say Social Dominance peaked at 0.59% before settling near 0.39%, while Positive Sentiment shot past 14 on June 27th.

Translation? The community’s fired up, media’s paying attention, and SEI’s stepping into the spotlight.

But beware, when the crowd gets loud, speculators often follow, and that can mean trouble or opportunity.

Fresh capital?

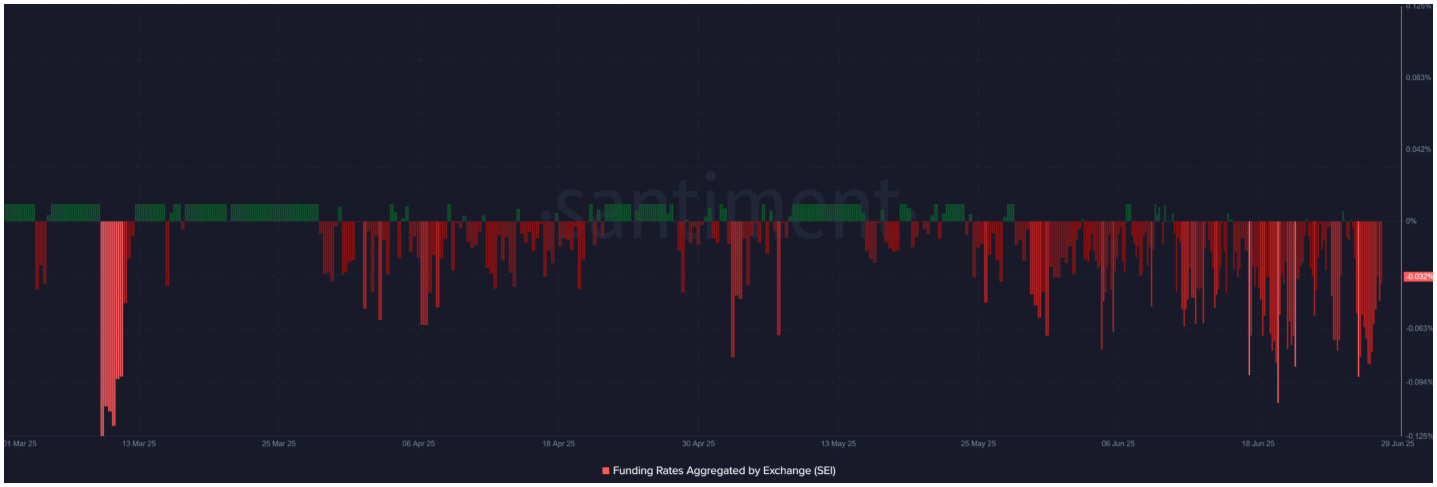

But despite all this on-chain action and good vibes, the derivatives market is playing hard to get.

Funding Rates are still stuck in the red at -0.032%, signaling that the shorts, the bearish traders betting against SEI aren’t ready to throw in the towel just yet.

It could explode into a short squeeze if SEI’s price keeps climbing and forces those bears to cover.

Adding fuel to this fire, Open Interest jumped nearly 8% to over $310 million, showing that big money’s circling back.

Both bulls and bears are gearing up for the next round, making this a high-stakes poker game.

The question is, will fresh capital keep flowing, or will the well run dry as SEI eyes its next big hurdle at $0.35?

Resistance

Speaking of $0.35, that’s the battleground now. SEI has busted out of its bearish channel after months of struggle, hanging around $0.3039 and inching closer to the resistance.

The RSI reading at 67.89 tells us bulls have the edge but aren’t overextended yet, kind of like a sprinter just before the final stretch.

If volume backs it up, we might see a clean break. But if SEI stumbles here, expect some price squeezing or a fallback to the breakout zone.

SEI’s breakout is real, powered by a noticeable growth in users, speculative interest, and positive sentiment.

But don’t get too comfy, because the negative funding rates and that $0.35 resistance are like those office deadlines looming over your head.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.