Solana memecoins are staging a return. After months of being down and out, trading volumes are surging, prices are climbing, and the Solana network itself is shaking off the dust. But don’t pop the champagne just yet, this story’s got layers.

Resurrection?

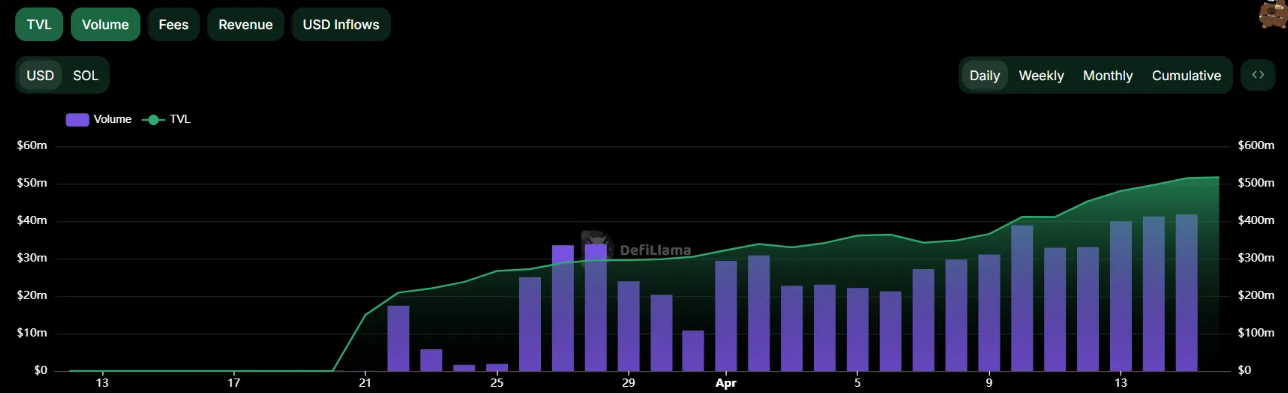

Daily trading volumes for Solana memecoins are skyrocketing. Take Axiom, for example, a meme trading platform that hit $100 million in daily volume on April 14, dominating half of the market share for Solana meme trades.

Meme trading platform Axiom's daily trading volume exceeded $100 million for the first time on April 14, accounting for about 50% of the market share of Solana Meme trading platform; the number of trading users reached 26,800, a record high. Axiom's advantages include the support…

— Wu Blockchain (@WuBlockchain) April 15, 2025

That’s not all. Pump.fun, another player in this space, just launched Pumpswap, a decentralized exchange that’s already captured 14% of Solana’s DEX market.

Trading on Pumpswap jumped 50% in a single day. Impressive? Sure. But let’s not forget where these coins were just weeks ago, Goblin Town.

But why the sudden revival? For starters, macroeconomic fears are cooling off, giving speculative assets like memecoins some breathing room.

And while controversies like pump-and-dump schemes and tariff chaos dented their reputation earlier this year, it seems traders can’t resist the allure of high-risk, high-reward plays.

Up

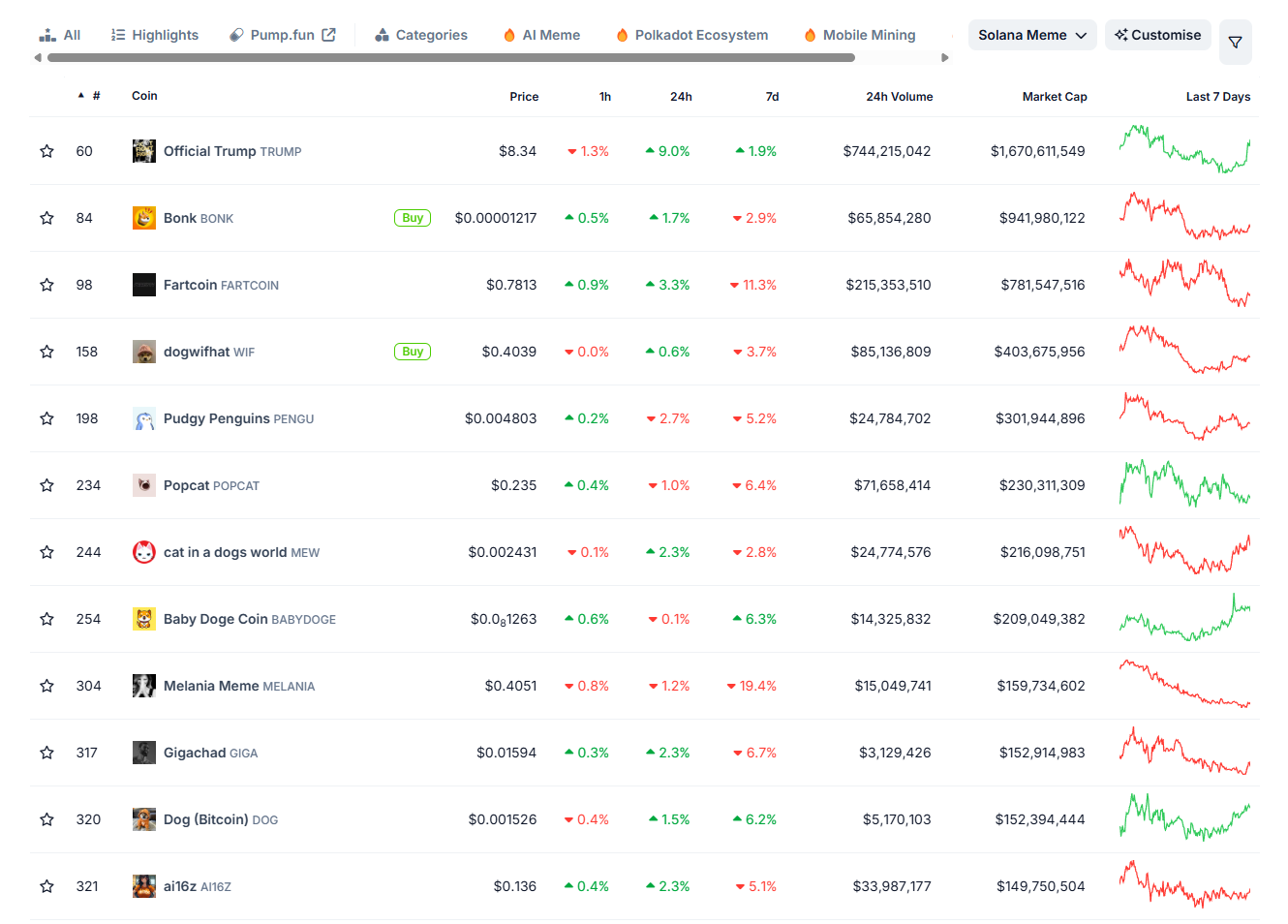

But let’s talk numbers because they don’t lie. Eight out of the ten largest Solana memecoins posted double-digit gains last week.

Even TRUMP, a token plagued by tariff issues and a recent token unlock, managed a 4.5% price bump. Most of its peers?

They jumped over 20%. And it’s not just the tokens themselves, Solana’s native coin is riding this wave too, bouncing back from a 12-month low with a 20% price gain.

Still, let’s not get ahead of ourselves. While these gains are promising, they’re far from the all-time highs we saw back in January.

The road to full recovery is long, and one macroeconomic shock could send these assets tumbling again.

Speculation

So what does this mean for Solana, and memecoin traders? Well, increased activity around memecoins is boosting its network metrics and helping it regain relevance in the crypto market.

But it also highlights a deeper truth, speculative mania drives much of this market. Whether that’s sustainable or just another bubble waiting to pop remains to be seen.

For now, Solana memecoins are indeed enjoying their moment in the sun. But as any seasoned trader will tell you, what goes up can come down just as fast. Be prepared!

Have you read it yet? Coinbase urges Australia to stop dabbling, and start leading on crypto

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.