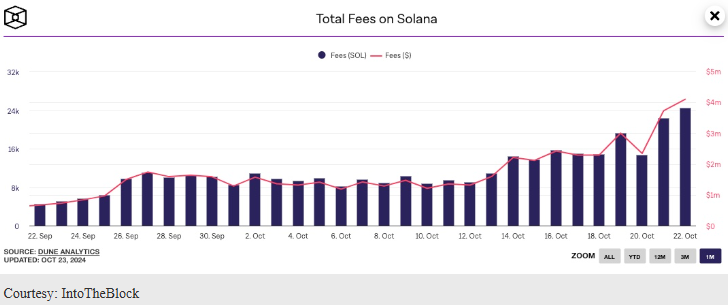

The blockchain platform has just overtaken Ethereum in daily fees, raking in over $4.1 million.

This surge is largely thanks to the wild, some would say insane excitement surrounding memecoins, particularly the GOAT token, which has been driving up activity on the network.

Memecoin paradise

Solana is really catching fire lately. As of now, the price of SOL has jumped by 5.62%, reaching $174 in the time of writing, and its market cap has jumped to an impressive $82 billion.

It seems like everyone wants a piece of the action, especially with AI memecoins becoming the hot new trend.

Solana takes the lead

Solana’s daily fees officially surpassed those of Ethereum. So, what’s behind this sudden spike? The frenzy around AI memecoins on Solana is a major factor.

One standout is Goatseus Maximus, which has skyrocketed over 40% in a single day to hit an all-time high of $0.7009, pushing its market cap past $700 million.

What’s even more impressive? The GOAT token achieved this milestone just two weeks after its launch on October 10, thanks to some savvy promotion by an AI bot called ‘Truth Terminals.’

David Zimmerman, a DeFi analyst at K33 Research,noted that a whole narrative was born from the intersection of AI, memecoins, and crypto.

In just two weeks, AI memecoins have gained massive attention, with several tokens reaching market caps over $100 million.

SOL price on the rise

Solana isn’t just sitting pretty, it’s outperforming some heavyweights like Bitcoin and Ethereum.

Over the past month, SOL has seen 18% increase in price, and many investors are hoping for an even bigger leap toward its all-time high.

Some analysts are even speculating that SOL could be on track for a parabolic rally that might push it all the way to $2,000!

Looking at Coinglass data, open interest in Solana has surged by 13.7%, now exceeding $3.4 billion.

Plus, derivatives trading volume has jumped by 25% in the last 24 hours, hitting $9.54 billion. Nice, but we don’t know if it’s enough for the $2,000, honestly.