Grab your popcorn because the Solana inflation reform vote was nothing short of a blockbuster.

The proposal, SIMD-228, wanted to slash Solana’s inflation rate by a quite nice 80%. Sounds bold, right? But in a dramatic twist worthy of Hollywood, the motion failed.

Rampant inflation is so good in the legacy monetary system, we need that in blockchain too

Validators across the network cast their votes, and just as the finish line came into sight, smaller validators swooped in with “No” votes, sinking the proposal below the required 66.67% supermajority.

Let’s break it down, how this happened? Solana’s inflation rate, currently sitting at 4.7%, is one of the highest among major blockchains.

The reform would’ve cut staking rewards to around 1%, a move that big validators loved because it promised long-term price stability for SOL. But small validators?

Not so much. For them, this was like pulling the rug out from under their feet. Lower rewards mean higher costs for running nodes, and many feared they’d be forced out of business.

Participation

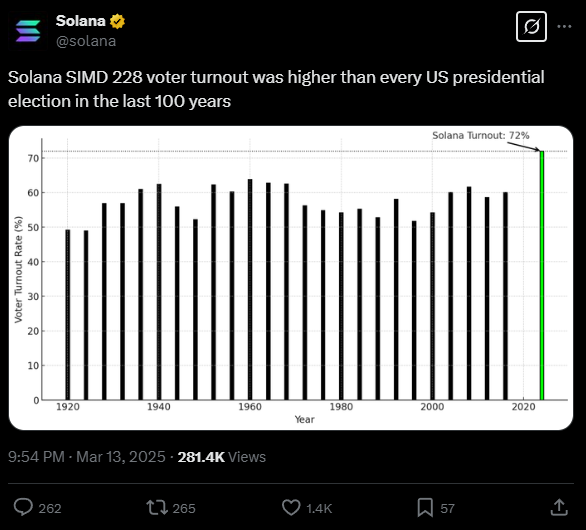

The voting turnout was massive, 74.3% of eligible stake weighed in on SIMD-228, making it one of the most participated governance events in crypto history.

To put it into perspective, Solana’s official account cheekily noted that voter turnout was higher than any U.S. presidential election in the last century.

Imagine that, blockchain governance outshining representative democracy.

But let’s not sugarcoat it, the defeat exposed some serious cracks in the system. Big validators backed the proposal under the rationale that cutting inflation would boost SOL’s value and attract institutional investors.

Meanwhile, small validators argued that slashing rewards would destabilize decentralization and make running nodes unprofitable.

In short, it was a battle between the whales and the people. And guess what? Stakeholder capitalism won, because this is how proof-of-stake works.

Governance test

Adding fuel to the fire were concerns about tokenomics. Lower inflation could’ve reduced $4 billion worth of annual SOL issuance, easing sell pressure and potentially driving prices up.

Sounds good on paper, but critics pointed out that smaller validators would bear the brunt of these changes. Translation: smaller validators want to earn.

In the end, SIMD-228 failed to pass, a first for Solana’s economic reforms.

Tushar Jain from Multicoin Capital called it a stress test for decentralized governance, while others saw it as proof of deep divisions within the ecosystem.

So there you have it, a high-stakes drama with no happy ending. Solana’s inflation stays high, and while some call this a missed opportunity for progress, others see it as a victory for decentralization.

Have you read it yet? Binance’s red alert: don’t get scammed, guys!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.