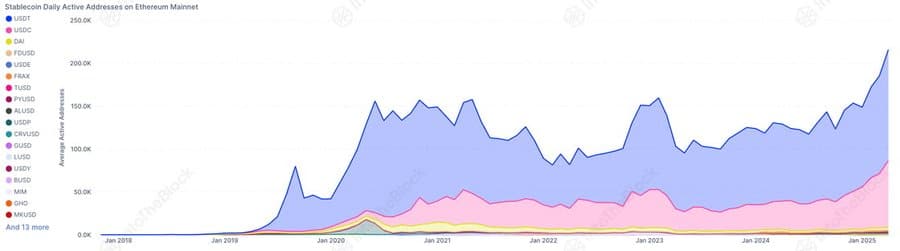

Something’s brewing on the Ethereum mainnet, and it’s not just another flashy headline. Over 200,000 unique addresses are now holding stablecoins, and that’s a big deal.

Not everyone likes the big volatility

Stablecoins, once just trading tools, have become the lifeblood of Ethereum’s ecosystem. They’re no longer just observers, they’re the party. USDT is leading the pack, with USDC and DAI close behind.

Now this looks like a sustained movement towards a utility-focused digital economy, as Ethereum’s robust infrastructure and DeFi applications have made it the go-to place for stablecoins.

But why are stablecoins so appealing? Well, in a volatile crypto market, they offer a safe haven.

They’re like the calm in the storm, providing a secure store of value and a reliable medium of exchange.

Between mid-2023 and March 2025, daily stablecoin activity skyrocketed, showing just how much users trust them.

Bigger role

Now, this rise in stablecoin activity isn’t just good news for Ethereum, it’s also a game-changer for the entire crypto industry.

It means more liquidity, faster transactions, and new opportunities in cross-border finance. But, of course, with great power comes great scrutiny. Regulators are watching closely, focusing on transparency and compliance.

New paradigm

Ethereum might be leading the charge, but worth to mention that it’s not alone at all. Other blockchains like Solana and Base are nipping at its heels.

Whether it’s multichain growth or deeper integration, stablecoins have become the backbone of on-chain finance.

But what does this mean for the average user? Well, if you’re in the crypto market, you’re probably already feeling the shift. Stablecoins are cementing their role as the reliable workhorses of the digital economy. It’s time to take notice.

Have you read it yet? Is PEPE in free fall?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.