The US government shutdown entered its third week and froze key crypto ETF decisions. Agencies, including the SEC, operate with essential staff only. Therefore, deadlines slipped with no public orders.

The pending stack includes at least 16 crypto ETF filings. They cover Solana ETF, XRP ETF, Litecoin ETF, and Dogecoin ETF proposals. The SEC must act before any crypto ETF can launch.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Most federal operations slowed on Oct. 1. Lawmakers missed a funding deal. As the US government shutdown continues, the crypto ETF pipeline stays idle.

SEC Staffing and ETF Pipeline: 16 Crypto ETF Decisions in Limbo

The SEC is handling only essential work. As a result, several crypto ETF deadlines passed without action. Sponsors now sit in a waiting phase.

October was set for clustered decisions on crypto ETF applications. At least 16 were at final stages, with 21 new filings in the first eight days. The US government shutdown paused that schedule.

These crypto ETF proposals aim to give regulated exposure to Solana, XRP, Litecoin, and Dogecoin. Yet, without formal SEC orders, the crypto ETF market remains on hold.

What Congress Must Do to End the US Government Shutdown

To end the US government shutdown, Congress must pass funding. Lawmakers can approve 12 appropriations bills. Or they can pass a continuing resolution that extends current spending.

The House and the Senate must both act. After passage, the President can sign the bills. Only then do agencies, including the SEC, return to normal pace.

The Senate is not scheduled to vote until Tuesday. The House is out of session. Until votes occur, crypto ETF reviews remain constrained.

Debt and Party Positions: $37.8 Trillion Shapes the Fight

Talks center on spending and the national debt. The total sits above $37.8 trillion, about $111,000 per person in the United States. These numbers frame both sides’ positions.

Republicans seek lower spending and more border enforcement funding. They cite the debt path and deficit control. Those demands guide their negotiating stance.

Democrats oppose healthcare cuts. They also want to extend expiring tax credits that lower health insurance costs. The gap keeps the US government shutdown active and the crypto ETF calendar stalled.

Analyst Reactions: “ETF Floodgates” and Altcoin Season

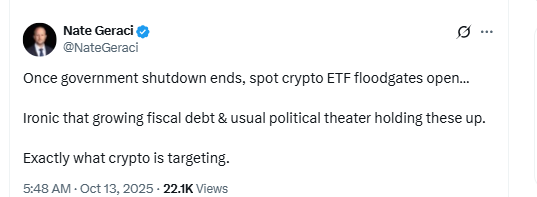

Nate Geraci, an ETF analyst and president of NovaDius Wealth Management, wrote on X:

“Once government shutdown ends, spot crypto ETF floodgates open.”

He added,

“Ironic that growing fiscal debt & usual political theater holding these up. Exactly what crypto is targeting.”

His remarks address timing rather than outcomes. He points to clustered approvals after the US government shutdown ends.

The phrase “ETF floodgates” underscores how many crypto ETF files are ready.

Bitfinex analysts said in August that broad crypto ETF approvals could support altcoins.

They argued that regulated products reduce access frictions. In that view, a live Solana ETF, XRP ETF, Litecoin ETF, or Dogecoin ETF could broaden participation.

Altcoin Season Hangs on Process, Not Hype

“Altcoin season” refers to periods when non-Bitcoin assets lead gains. Proposed crypto ETF products tied to Solana, XRP, Litecoin, and Dogecoin feature in that discussion. The SEC backlog keeps the start line unchanged.

Sponsors prepared for October decisions across multiple crypto ETF files. The US government shutdown froze that momentum. Each delayed order adds to the queue.

Investors now track SEC dockets, sponsor notices, and Congress calendars. When funding resumes, the SEC can process the crypto ETF stack. Until then, crypto ETF approvals remain pending.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 13, 2025 • 🕓 Last updated: October 13, 2025