Strategy stock (MSTR) dropped to $336.57, the lowest level since April 17. The decline marks a 21.04% fall in one month.

The drop follows Bitcoin’s 8.6% decline, falling from $124,128 last Thursday to $113,638.

Other Bitcoin treasury companies also reported stock losses. MARA Holdings (MARA) declined 19.44%, Coinbase Global Inc (COIN) dropped 26.97%, and Riot Platforms (RIOT) fell 14.69% in the past month.

Strategy’s last trade at this level occurred in April, when Bitcoin’s price stood at $84,030.

The company’s performance highlights the close link between Strategy stock and Bitcoin price movements.

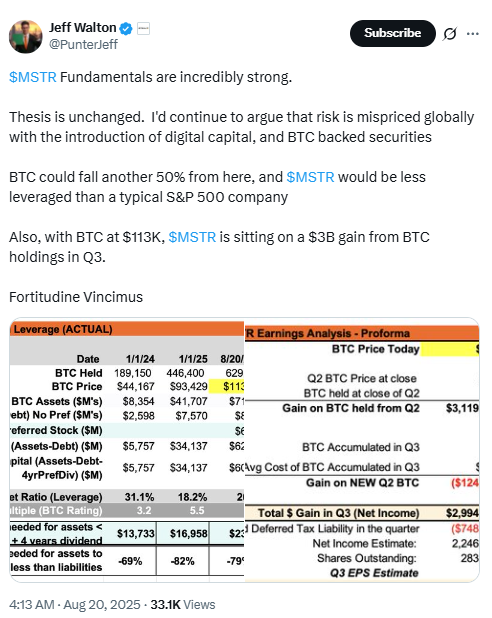

Michael Saylor Updates Strategy MSTR Issuance Policy

Michael Saylor announced changes to Strategy’s MSTR Equity ATM Guidance. The company lowered restrictions on issuing new shares.

Previously, Strategy limited issuing shares below 2.5 times its net asset value (mNAV) to debt payments or preferred equity dividends.

In an X post on Monday, Saylor wrote:

“Strategy today announced an update to its MSTR Equity ATM Guidance to provide greater flexibility in executing our capital markets strategy.”

The new guidance allows Strategy stock to be issued below 2.5 mNAV not only for debt and dividends but also “when otherwise deemed advantageous to the company.”

At present, Strategy mNAV stands at 1.55, showing that the company trades well below the value of its Bitcoin holdings.

Strategy Shareholders React to Policy Change

Saylor’s update divided the community. Some pointed to the change as a way for Strategy to secure more Bitcoin purchases, while others criticized the reversal from its earlier earnings report.

Crypto trader Kale Abe commented:

“He’s literally telling you straight up he’s gonna buy a… ton more BTC.”

According to SaylorTracker, Strategy holds 629,376 Bitcoin, valued at $71.34 billion.

Former shareholder Josh Man said he felt misled:

“The head of the company said he wouldn’t sell below 2.5 mNAV, so I bought. He made this agreement with the shareholder at the live earnings release. And then he sold below mNAV 2.5.”

Developer Endre Stolsvik viewed the policy shift as practical under current market conditions:

“The ‘no issue below mNAV 2.5’ was too strict, given that we’re far away, now at 1.59.”

Bitcoin Treasury Stocks Under Pressure

The decline in Strategy stock reflects wider weakness among Bitcoin treasury companies. Falling Bitcoin prices have directly impacted equity values for firms holding large Bitcoin reserves.

Strategy remains the largest corporate Bitcoin holder, with more than 629,000 BTC. However, companies like MARA, COIN, and RIOT also recorded double-digit stock losses during the same period.

The combined downturn emphasizes the close correlation between Bitcoin price and the performance of listed Bitcoin treasury companies.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 20, 2025 • 🕓 Last updated: August 20, 2025