Tether bought 4,812.2 Bitcoin worth $458.7 million for Twenty One Capital on May 9. The average price per Bitcoin was $95,319.

The stablecoin issuer moved the funds into an escrow wallet, according to Cantor Equity Partners’ filing with the U.S. Securities and Exchange Commission (SEC) on May 13.

Twenty One Capital is currently operating under Cantor Equity Partners as it prepares to complete a Special Purpose Acquisition Company (SPAC) merger. After the merger is finalized, the firm will trade under the ticker XXI.

The new Bitcoin purchase brings Twenty One Capital’s total holdings to 36,312 BTC. Of that, Cantor Equity Partners is holding 31,500 BTC on behalf of the firm.

Twenty One Capital Becomes Third Largest Bitcoin Holder

Twenty One Capital is now the third-largest corporate holder of Bitcoin. According to BitcoinTreasuries.net, only Strategy and MARA Holdings hold more.

Strategy owns 568,840 BTC, and MARA Holdings holds 48,237 BTC.

Jack Mallers, the CEO of Twenty One Capital, said on May 13 that the merger approval process is already underway. However, he did not give a date for completion.

The firm told the SEC in an April presentation that its key performance measure will be Bitcoin per share, not earnings per share. It plans to prioritize Bitcoin accumulation over profit generation.

Tether, Bitfinex, and SoftBank Support Bitcoin Treasury Plan

Tether holds a majority stake in Twenty One Capital. Crypto exchange Bitfinex is also a stakeholder. Cantor Fitzgerald is sponsoring the SPAC merger and has secured $585 million to support Twenty One’s Bitcoin buying efforts.

SoftBank, a Japanese investment holding company, has invested $900 million into the firm. Twenty One Capital aims to collect 42,000 BTC before going public.

Based on earlier filings, Tether is expected to contribute 23,950 BTC, SoftBank 10,500 BTC, and Bitfinex around 7,000 BTC. All three contributions will convert into equity shares at $10 per share.

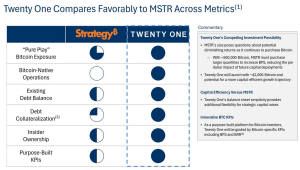

Twenty One Capital Challenges Strategy’s Bitcoin Exposure Model

Twenty One Capital’s SEC filing described its model as different from that of Strategy. It referred to itself as a “pure play” Bitcoin exposure firm with more flexibility for capital raises and Bitcoin-native operations.

The firm compared its treasury approach to Strategy’s and said it wants to serve as an alternative for investors looking for capital-efficient Bitcoin exposure.

The Bitcoin per share model reflects the firm’s intention to expand its BTC reserves without focusing on traditional profitability metrics.

Cantor Equity Shares React to Bitcoin Purchase

Cantor Equity Partners’ share price rose from $10.65 to $59.73 on May 2. After that, the price declined to $29.84.

Following the latest Bitcoin acquisition, the stock gained another 5.2% in after-hours trading, according to Google Finance.

Until the merger finalizes, Twenty One Capital will continue to operate under Cantor Equity Partners.

Once the deal is complete, the firm will trade independently under the ticker XXI, backed by its Bitcoin treasury.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.