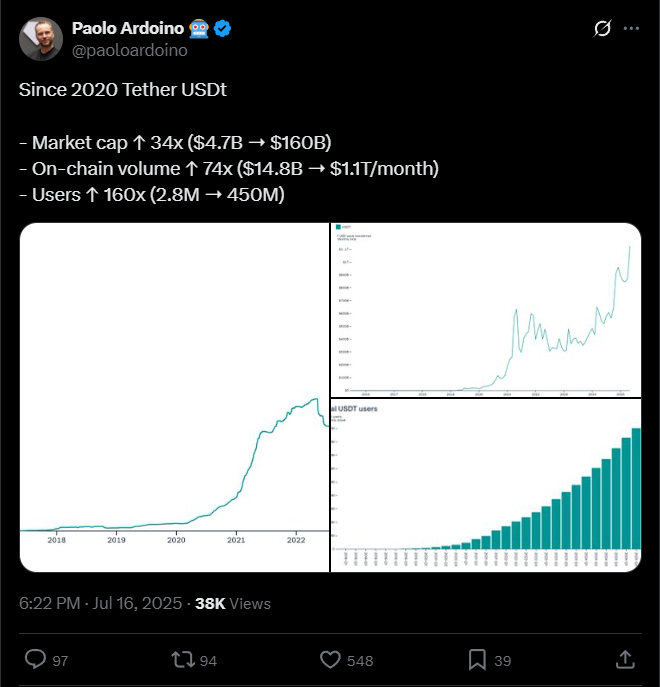

Tether’s star player, the stablecoin USDT, just smashed through the $160 billion supply ceiling.

On July 16, 2025, they minted a $2 billion fresh batch of USDT, pushing the total floating around crypto land to $160.26 billion.

USDT is a go-to digital dollar for anyone looking to dodge crypto chaos and dollar drama alike.

Protecting savings

So, how’d we get here? Back in the day, USDT was mostly a big shot for traders, like the hotshot in the bullpen knocking investments outta the park.

But now? It’s way-way bigger than that. Tether’s CEO, Paolo Ardoino, ain’t shy about it.

He’s crowning USDT as the trusty shield for people in emerging markets, places where local currencies get tossed around like a rag doll in a hurricane, like Nigeria, Argentina, Lebanon, and Turkey.

These are people using USDT like their own digital fortress, protecting savings from hyperinflation and making remittances less like a headache, more like a breeze.

Keeping the system fluid

Now, about that $2 billion mint on July 16, in fact it wasn’t just a wild cash splash. Nope.

Half of it, $1 billion, went straight to Binance, ready to soothe the thirst of heavy exchange traders.

The other half, $1 billion, is chilling on Ethereum, prepped for those nifty swaps and cross-chain moves.

This strategy keeps the whole system fluid without sending tokens flooding every corner of the market.

It’s like having your best enforcers spread out just right, keeping order without causing a trouble.

When audit?

And the big thing is that Tether’s not playing hide-and-seek with backing. They got over $127 billion parked in U.S. Treasury bonds, money markets, and solid financial instruments.

It’s all about keeping the empire legit and stable, no funny business.

Plus, with regulatory rumblings like the GENIUS Act, and the grand plan to diversify into real-world assets like farmland and oil-backed tokens, the empire’s future strategy looks sharp and ready for the next chapter.

After all, USDT isn’t just the crypto world’s safe harbor anymore.

It’s the bridge between digital dreams and real-world dollars, steadily becoming the backbone of not just traders, but billions of people across continents.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.