Thailand’s Ministry of Finance plans to issue $150 million worth of tokenized government bonds.

The offering will allow retail investors to buy in with a minimum of 100 baht, or around $3.

The launch will take place within the next two months, according to a report from the Bangkok Post on May 13.

Finance Minister Pichai Chunhavajira confirmed the decision following a cabinet briefing. The initiative aims to expand access to digital government bonds, previously limited to institutional and high-net-worth investors.

Patchara Anuntasilpa, director-general of the Public Debt Management Office, said these tokenized bonds will not be classified as traditional debt instruments.

He added that the government will use them to raise funds under its current borrowing plan.

Tokenized Government Bonds Branded as G-Tokens

The digital bonds will be known as G-tokens. They will be distributed and traded on regulated digital asset exchanges in Thailand. However, these platforms are not accessible to non-Thai residents living in the country.

Officials stated that G-tokens are not cryptocurrencies. Instead, they represent a new format for retail access to government securities using blockchain-based systems.

Retail investors in Thailand have historically been excluded from direct participation in large-scale government bond sales.

The G-token system addresses that gap, enabling public access with a very low investment threshold.

G-Tokens May Offer Higher Yield Than Bank Deposits

Finance Minister Pichai Chunhavajira noted that G-token holders will receive higher returns than fixed bank deposits. However, he did not disclose any specific figures.

At present, Thailand’s commercial banks offer around 1.25% interest on 12-month fixed deposit accounts.

This rate is significantly lower than the central bank’s policy interest rate, which remains high due to broader economic conditions.

By comparison, the G-tokens are expected to provide more attractive returns. Still, the exact interest structure or timeline for payouts was not mentioned during the announcement.

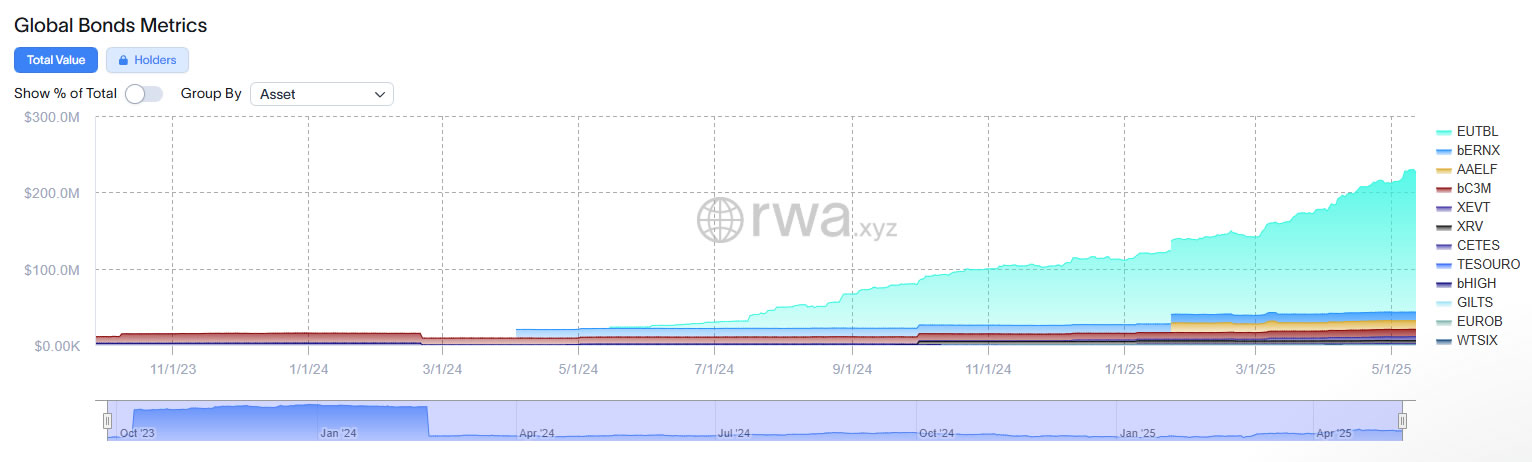

Global Value of Tokenized Bonds Reaches $225 Million

The tokenized government bond sector is expanding globally. Data from RWA.xyz, a real-world asset tokenization platform, shows that the global value of tokenized government bonds has reached $225 million as of May 2025. The figure has doubled since the start of the year.

The platform tracks tokenized assets across multiple regions, with a strong concentration in Europe. However, the true global value may be higher due to limited tracking coverage.

Thailand’s $150 million bond offering adds a significant share to this market. It signals the country’s entry into the growing space of digital public securities.

Tokenized U.S. Treasuries Climb to $6.9 Billion

According to RWA.xyz, tokenized U.S. Treasuries now stand at $6.9 billion, showing a 73% increase this year.

This data highlights how governments and financial entities are increasingly shifting public debt instruments onto blockchain systems.

Thailand’s upcoming tokenized government bonds align with this trend. The country is using blockchain-based tools to distribute traditional financial assets to a wider group of investors.

The tokenized bond model, while still limited in global volume, is gaining traction. Institutions and regulators are adopting it for both retail and institutional market access.

Thailand Securities Regulator Prepares Institutional Trading Platform

In February 2025, Thailand’s Securities and Exchange Commission announced it was developing a tokenized securities trading system. That platform will focus on institutional trading rather than public investment.

The G-token plan follows a separate path. It is structured to allow everyday investors to take part in government debt funding, using digital distribution without exposure to cryptocurrencies.

Both developments show Thailand’s growing use of blockchain infrastructure for state-backed financial products.

The tokenized government bonds initiative combines regulated digital trading with low-entry access for retail participants.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.