The crypto market’s been doing its usual dance, up, down, sideways. Annoying, but it is, what it is.

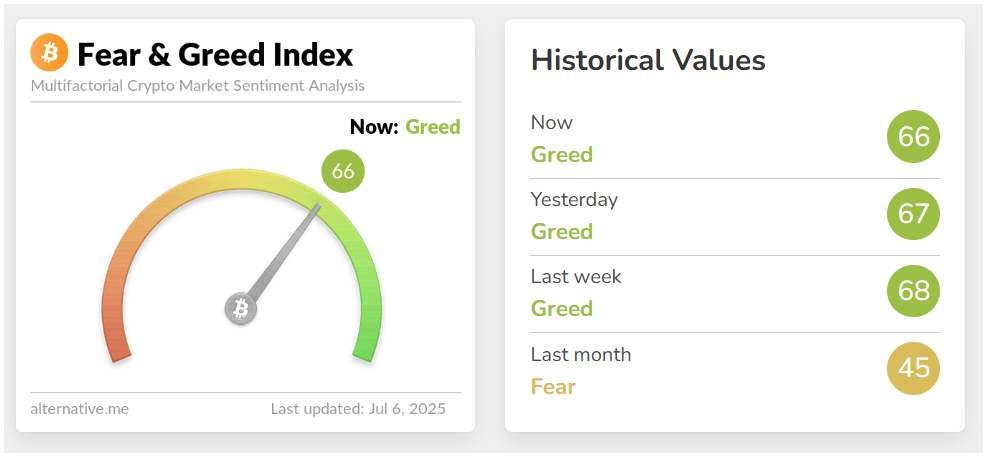

The big headline? The Crypto Fear and Greed Index is flashing a solid 66, which means the market’s swimming in greed waters right now. But don’t get too comfy just yet, okay?

Holiday weekend

Back on May 23rd, that index hit 78, right when Bitcoin strutted its stuff at $111.8K before getting slapped down by the market gods.

Fast forward to now, and the index is flirting with those same greedy vibes. Bitcoin’s just a hair, 3.9% below its ATH, so a lot of people are sitting pretty with some nice profits.

Naturally, some short-term players decided to cash out on July 4th, causing a little sell-off.

Classic profit-taking move, like snagging the last donut before the boss sees it. Holiday weekend, nothing to see here.

But since June 23rd, Bitcoin’s been on a slow and steady climb, up 6.3%, while alts have been trying to keep pace, gaining about 7.6%. Not bad, right?

Yet, altcoins are lagging behind Bitcoin lately, which is a red flag for anyone betting big on those smaller coins.

It’s like your coworker who’s always late to meetings, reliable? Not so much.

Geopolitical sh*tstorm

Now, sprinkle in some geopolitical drama, because who doesn’t like drama?

Trump-tariffs are about to expire, and while the U.S. has smoothed things over with China and Vietnam, deals with heavy hitters like Japan, South Korea, and the EU are still up in the air.

The threat of a trade war isn’t helping the mood, adding some jitteriness to the market.

Imagine trying to close a deal while your phone’s blowing up with urgent emails. Stressful, right?

Endure

Despite all this, investor hunger is still roaring. On July 3rd, Bitcoin ETFs saw a massive inflow of $601 million, the biggest since May 22nd’s $934 million.

Ethereum’s not far behind either. So, the big players aren’t running for the hills, they’re doubling down.

Now, the Crypto Fear and Greed Index is telling you to hold your horses and maybe even HODL hard.

Greed doesn’t mean the party’s over, it just means some people are cashing in while others are gearing up for the next big move.

Bitcoin’s trading in a pretty tight range, and while alts might wobble, the on-chain data hints that a fresh rally could be just around the corner.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.