Economist Timothy Peterson is warning about a bear market. Listen up, guys, the Federal Reserve’s decision to hold off on rate cuts in 2025 could be the spark that ignites a bear market, and Bitcoin might just get dragged down with it.

Peterson thinks if the Fed doesn’t budge, it could trigger a broader market downturn, potentially sending Bitcoin back to around $70,000.

The Fed’s stance: no rush

Federal Reserve Chair Jerome Powell made it clear, and said that they’re in no hurry to adjust interest rates.

“We do not need to be in a hurry and are well-positioned to wait for greater clarity.”

This stance has Peterson predicting a potential bear market, with Bitcoin taking a strong hit. But don’t expect it to plummet to $57,000, or at least, Peterson thinks that’s unlikely.

? Because investors are circling Bitcoin like vultures, ready to swoop in at the first sign of a low price.

The math behind the prediction

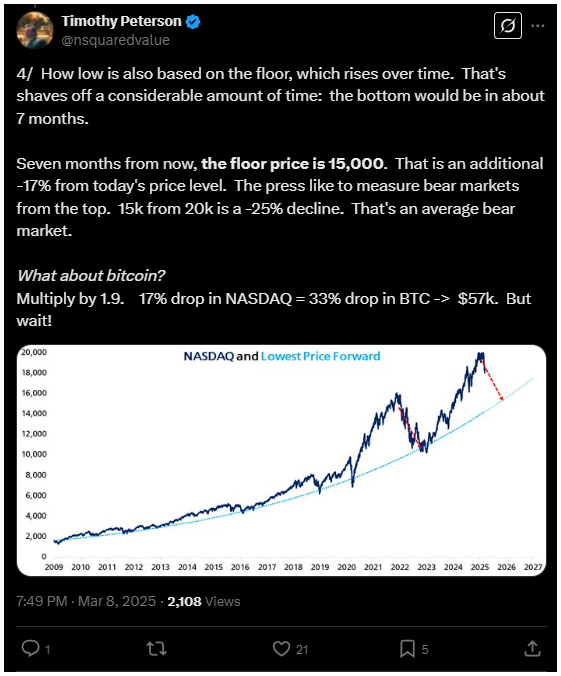

Peterson’s model suggests the Nasdaq could drop by 17% over seven months in a bear market.

Applying a multiplier to this, he estimates Bitcoin could fall by 33%, from its current price to around $57,000. But historical trends say otherwise.

In 2022, everyone thought Bitcoin would bottom out at $12,000, but it only hit $16,000. Peterson expects a similar scenario this time, with Bitcoin finding a floor closer to $70,000.

Other voices in the mix

BitMEX co-founder Arthur Hayes agrees, predicting a correction to $70,000 to $75,000 before Bitcoin surges to $250,000 by year’s end.

Meanwhile, Blockware Solutions thinks Bitcoin’s bear case for 2025 could be as high as $150,000 if the Fed reverses course on rate cuts.

It’s a mixed bag, but one thing’s clear, the Fed’s decision will have a ripple effect, and Bitcoin’s fate is tied to it.

Have you read it yet? Altcoins in free fall

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.