Solana is now stepping onto Wall Street’s grand stage. It used to be the grey zone out there, ya know? Crypto was the tricky kid in class, no rulebook, no hall pass.

Fast forward now, and the U.S. Securities and Exchange Commission has cracked open the door to a new chapter.

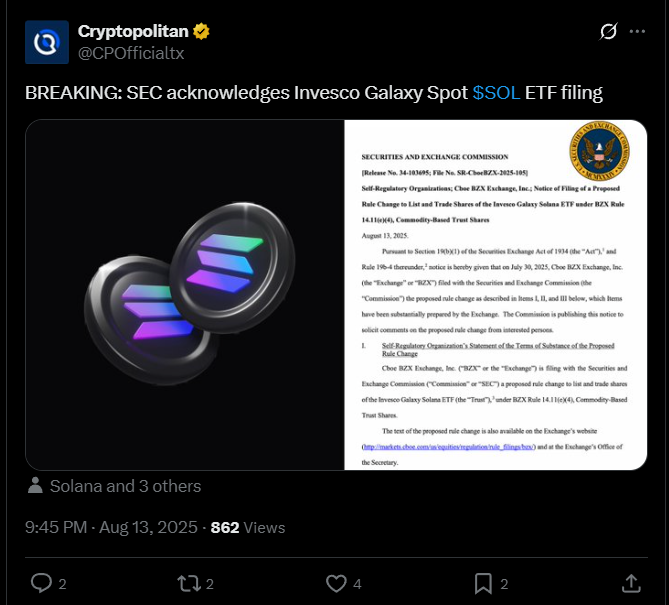

They’ve started their review of Invesco and Galaxy Digital’s pitch to launch the first-ever spot Solana ETF.

Welcome to the big league

This filing, riding shotgun with the Cboe BZX Exchange, just kicked off the official SEC review phase. Could we see approval by the end of the year?

The rumor mill says so, but it’s a crowded arena, so not so fast. VanEck, Fidelity, Bitwise, and a slew of big money players ain’t sitting quiet.

They’re all eying their own Solana ETF dreams as well. In fact, REX Shares already got their Solana ETF declared immediately effective, their words, back in May.

Plus, the fact that CME Solana futures exist and the current administration’s pretty chill with crypto just adds gasoline to this optimism.

Playing it safe

But don’t get too cozy yet, it’s not a walk in the park. Regulators are stubborn, and are chewing over one big question, is Solana a commodity or a security?

And that distinction, guys, flips the script on everything. If Solana’s branded a security, watch out, crippling red tape, tighter licenses, and some exchanges might just say, no thanks, we’re out.

The SEC’s notorious for playing it safe with crypto ETFs. Expect elongated review periods with multiple delays, endless questions about protecting investors, and worrying over market shenanigans.

Ready to roll

So what’s at stake? The answer is more than just a stamp of approval. A Solana spot ETF could actually rewrite crypto trading’s playbook in America.

Setting the rules for all. For all of us in the industry, imagine the tension when a big client’s portfolio hinges on this decision, every email, every meeting, hanging on that SEC call.

It’s the kind of financial drama that beats any episode of your fav sitcom, except this time, it’s real money, real risk, real drama.

Right now, everyone’s eyes are glued to the SEC.

This decision might be the spotlight that finally pulls Solana out of the shadows and into the center, legit, regulated, and ready to roll in the big leagues.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 15, 2025 • 🕓 Last updated: August 15, 2025

✉️ Contact: [email protected]