Dennis Porter, CEO and co-founder of the Satoshi Act Fund, announced that over 120,000 letters have been sent to state lawmakers urging their support for the Strategic Bitcoin Reserve bill.

That’s a lot of voices coming together, demanding actions from their public servants!

Call to arms

Porter shared that the letters were split fairly evenly, with 60,500 sent to Republican representatives and 62,300 to Democrats. The goal?

To convince lawmakers of the benefits of adopting Bitcoin. It seems like the crypto crowd is serious about making their voices heard.

The push for this bill comes as representatives are just starting to discuss how to implement it.

The Satoshi Act Fund emphasized that public input is quite important in persuading lawmakers to take action.

In Pennsylvania, house representatives are gearing up to introduce a bill that would allow the state to use Bitcoin as a strategic reserve asset.

If passed, this bill would enable the state treasury to redirect 10% of funds from various accounts, including the State Investment Fund and the Rainy Day Fund, to purchase BTC.

Republican Representative Mike Cabell is behind this initiative.

Senator Lummis pushes for national Bitcoin strategy

This follows a bipartisan Bitcoin bill passed on October 23, aimed at providing regulatory clarity for the state’s 1.5 million crypto users.

Cabell pointed out that the lack of clear regulations at the federal level, particularly from the U.S. SEC, has created confusion.

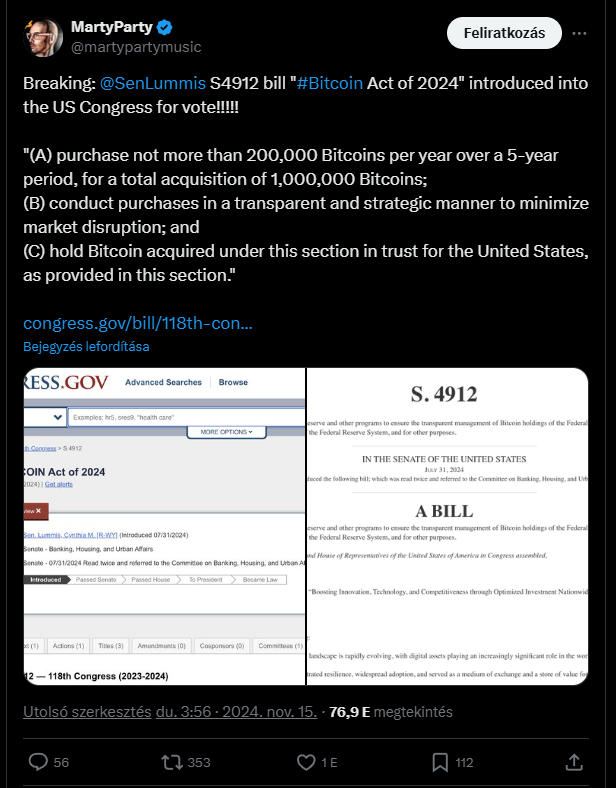

Of course, there are some move in the topic, as pro-crypto Senator Cynthia Lummis has introduced the ‘Bitcoin Act of 2024’ in Congress.

This ambitious act wants to ensure that the U.S. government consistently purchases Bitcoin over the next five years, with a goal of accumulating 200,000 BTC each year, eventually reaching a million BTC.

Lummis first introduced this idea back in July under a bill titled Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide.

She highlighted the economic challenges facing Americans due to high inflation and national debt and emphasized Bitcoin’s potential to revolutionize finance both in the U.S. and globally.

Worldwide changes

The senator believes that adopting Bitcoin as a savings technology could position the U.S. at the forefront of financial innovation while also helping reduce national debt.

She proposed that any BTC purchases be made strategically and transparently to avoid market disruptions, with plans for long-term storage in a trust for about 20 years—complete with regular audits.

Lummis has even suggested swapping out gold reserves for Bitcoin! According to Bloomberg, her plan aligns with Trump’s vision of increasing BTC holdings without adding to the country’s financial deficit.

With Trump’s election victory reigniting interest in these bills, it seems like there’s a fresh wave of enthusiasm around cryptocurrency legislation.

Bitcoin has also responded positively to this political shift, recently hitting an all-time high above $93,000 this week.