Donald Trump is weighing new CFTC chair candidates after Brian Quintenz’s Senate confirmation stalled.

The pause followed outreach from the Winklevoss twins over Gemini’s past enforcement disputes.

Meanwhile, CFTC leadership remains thin, with Caroline Pham serving as acting chair as talks continue on expanded crypto oversight.

CFTC chair search shifts: Michael Selig and Tyler Williams enter the frame

The Trump team is assessing Michael Selig for the CFTC chair role. He works on digital assets policy and has handled complex rulemaking. His background positions him for immediate work on crypto oversight.

At the same time, officials are discussing Tyler Williams. He advises on digital asset policy and previously worked in the private sector.

That mix could help with market structure questions at the Commodity Futures Trading Commission.

However, the White House has not dropped Brian Quintenz. It simply asked the Senate to pause. The choice now sits between restarting the Quintenz track or moving to Selig or Williams.

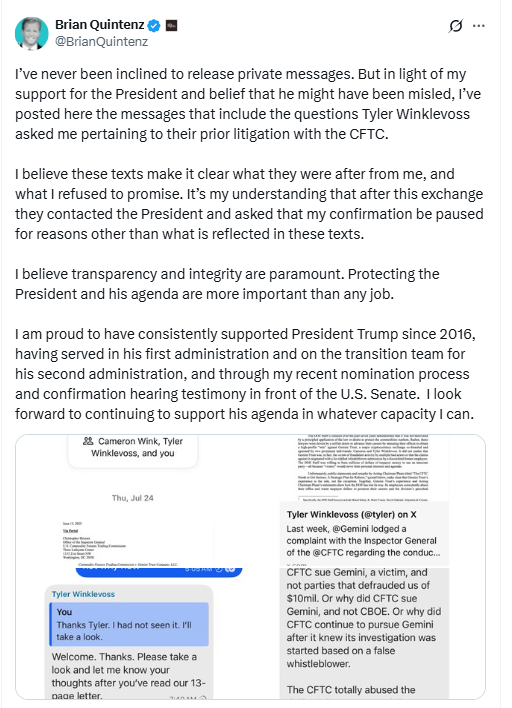

Winklevoss influence collides with Gemini enforcement history

The nomination hit trouble after the Winklevoss twins raised concerns tied to Gemini’s enforcement cases.

Their outreach followed several agency actions that affected the exchange. The pressure campaign coincided with the Senate confirmation delay.

Tyler Winklevoss said,

“Seven years of lawfare trophy hunting. It’s outrageous what they did to us.”

He framed the stretch as prolonged and costly. The line drew attention across political circles that track CFTC leadership.

Earlier this month, Brian Quintenz posted that Trump “might have been misled.” He shared screenshots from private messages to support his view.

The notes underscored how unusual the clash has become for a CFTC chair search.

Thin CFTC leadership: Caroline Pham carries the docket

Today, the CFTC operates with only Acting Chair Caroline Pham in the top seat. Recent departures left the commission short of members. As a result, routine business requires careful sequencing.

Even so, staff continue rulemaking and market surveillance. Filings still move, and oversight remains active. However, major votes typically require a full commission.

Therefore, the chair decision matters for timing. A confirmed CFTC chair would set priorities and calendars. It would also stabilize crypto oversight as new rules reach draft stage.

Policy track: “crypto sprint” and spot crypto asset contracts proposals

In parallel, the Commodity Futures Trading Commission advanced work on digital assets. Officials outlined a crypto sprint to study gaps and coordinate with other regulators. The plan seeks input from venues and clearinghouses.

Moreover, the agency opened talk on listing spot crypto asset contracts on registered futures exchanges.

The request asks how risk management, surveillance, and custody would function. It also examines how enforcement would apply.

These proposals shape the next chair’s agenda. Any CFTC chair must steer comment rounds and drafting. They also must sync timelines with the Senate and the market.

What holds up Brian Quintenz in the Senate confirmation path

First, the political fight around Gemini complicated the calendar. The Winklevoss twins used their platform to press their case. Coverage described their role as direct and well-funded.

Second, the White House avoided a hard break. It chose to assess options rather than force a floor vote.

That approach kept Quintenz viable while vetting Michael Selig and Tyler Williams.

Third, committee bandwidth remains limited. Hearings compete with other nominations and deadlines. Thus, the CFTC chair decision hinges on a clean package that can pass.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 19, 2025 • 🕓 Last updated: September 19, 2025