The U.S. Senate is delaying progress on major crypto regulation, including the GENIUS Act, following concerns over the Trump stablecoin deal.

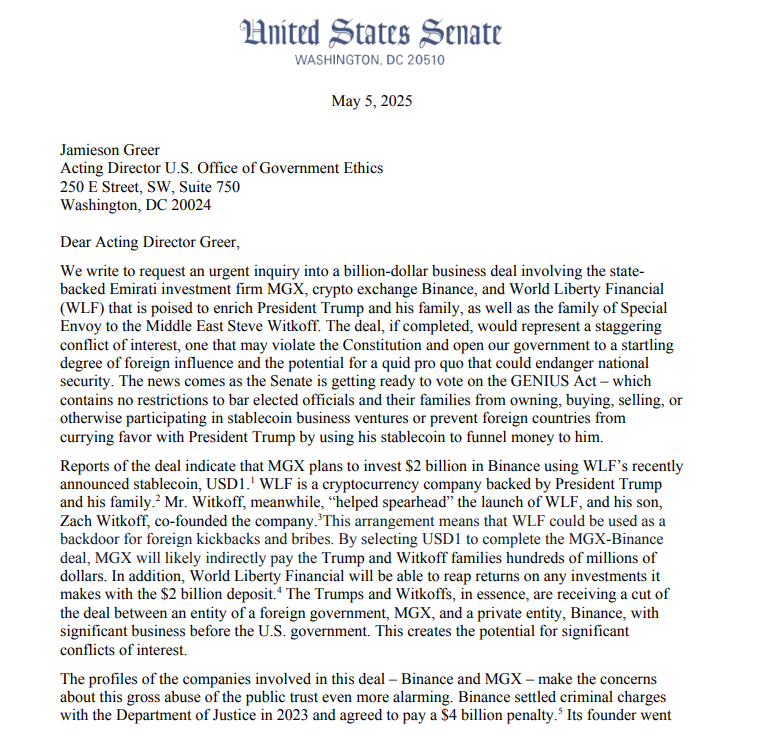

On May 5, Senators Elizabeth Warren and Jeff Merkley requested an ethics probe into Donald Trump’s links to a $2 billion crypto transaction involving UAE-backed MGX, World Liberty Financial (WLFI), and Binance.

According to the senators’ letter to the Office of Government Ethics, Trump and his family could profit from a deal involving WLFI USD1 stablecoin.

MGX, backed by the United Arab Emirates, plans to invest $2 billion into Binance using the WLFI USD1 token.

The senators warned the deal may breach the U.S. Constitution’s Emoluments Clause and federal bribery laws.

They stated that Trump’s allies could gain hundreds of millions through the transaction.

“This deal raises the troubling prospect that the Trump and Witkoff families could expand the use of their stablecoin as an avenue to profit from foreign corruption,”

Warren and Merkley wrote.

The Trump stablecoin deal has become a central issue in the debate around regulating stablecoins and digital assets in the U.S.

Trump Hosts $1.5 Million Fundraiser Amid WLFI USD1 Deal Concerns

The Trump stablecoin deal coincides with political fundraising events hosted by the former president.

On May 5, Trump held a $1.5 million-per-plate dinner at his golf club in Sterling, Virginia. Days earlier, he hosted a $1 million-per-plate fundraiser for the MAGA super PAC.

Another event is scheduled for May 22, where Trump will host a gala dinner with large holders of the Official Trump (TRUMP) memecoin.

Some lawmakers have raised questions about the links between these events and Trump’s ties to the WLFI USD1 token and Binance deal through MGX.

While no legal ruling has yet been made, the timing of the fundraisers, combined with the UAE-backed MGX investment and stablecoin use, has brought increased scrutiny to Trump’s financial dealings.

Lawmakers are examining whether these connections to the Trump TRUMP memecoin and WLFI USD1 stablecoin affect legislative neutrality in crypto policymaking.

GENIUS Act and Other Senate Crypto Bills Face New Delays

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act and other Senate crypto bills have stalled.

Some Democrats are now calling for additional hearings before voting on any crypto-related laws due to concerns about the Trump stablecoin deal and the ethics probe.

On May 5, Senate Majority Leader John Thune said that Republicans are open to making changes to the bill to move forward.

He told reporters that amendments could be made on the Senate floor, depending on Democratic input.

Internal Republican divisions also remain. Senator Rand Paul has not confirmed support for the bill, according to a report by Politico.

At the same time, House Financial Services Committee Ranking Member Maxine Waters is preparing to block a digital assets hearing scheduled for May 6.

The event, titled “American Innovation and the Future of Digital Assets,” is led by Representatives Glenn Thompson and French Hill. It includes a discussion paper focused on U.S. crypto markets.

The Trump stablecoin deal has now become a major factor influencing how Senate crypto bills will move forward.

Crypto Figures Criticize Political Resistance to Stablecoin Bill

Public responses to the stalled Senate crypto bills include criticism from the industry. Gemini co-founder Tyler Winklevoss posted on X, accusing Democratic leaders of blocking legislation.

“Elisabeth Warren and Chuck Schumer haven’t learned their lesson,”

Winklevoss wrote.

“If they want Democrats to continue losing elections, they will continue standing in front of crypto legislation like the stablecoin bill which they are stalling out in the Senate.”

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.