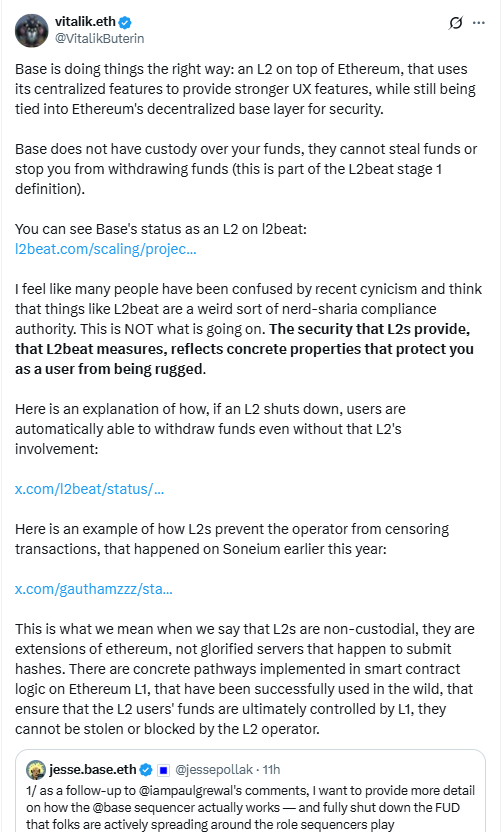

Vitalik Buterin defended Base layer 2 and other L2 sequencer designs after new regulatory concerns.

He said Base “is doing things the right way,” describing an L2 that improves user experience while anchoring to Ethereum security. His remarks landed on Tuesday and addressed questions around centralized sequencing.

Buterin stressed the non-custodial model.

“They cannot steal funds or stop you from withdrawing funds,”

he said, referring to Base. He framed “true layer-2s” as extensions of Ethereum, not standalone exchange services.

His comment followed debate about L2 centralization risks. It also followed questions about whether an L2 sequencer could be treated like a regulated exchange.

The discussion intensified after public remarks from SEC Commissioner Hester Peirce on September 7.

Are L2s exchanges? SEC view with details

Hester Peirce noted that some centralized sequencing helps lower costs and reduce front-running. She said if a “matching engine” is controlled by one entity, it “looks a lot more like an exchange.” She also said that if the assets are not securities, “then we don’t have a lot to say about it.”

Her thinking placed regulatory concerns on the design line between infrastructure and trading.

The issue is whether an L2 sequencer that orders transactions fits the exchange definition. That question determines obligations under SEC rules.

Buterin’s Ethereum argument answered the custody point. He emphasized settlement on the base layer and user ability to exit to L1.

That non-custodial property separates Base layer 2 from platforms that hold assets and match orders.

Coinbase says L2 sequencers are infrastructure, not exchanges

Paul Grewal, Coinbase chief legal officer, said calling L2 sequencers “exchanges” misunderstands the function.

He cited the SEC definition of an exchange as a venue that brings together buyers and sellers of securities. In his view, Base layer 2 is infrastructure.

Grewal explained that layer 2 systems run general-purpose code and batch many transaction types.

They process payments, smart-contract calls, and messages on Ethereum-anchored rails. Therefore, ordering code is different from pairing buy and sell orders.

He compared Base and other L2s to the AWS analogy.

“If an exchange runs on AWS, is AWS an exchange? Obviously not,”

Grewal said. The point places L2 sequencer services in the same bucket as compute providers.

Base clarifies sequencers vs. matching engines

Jesse Pollak, Base co-founder, detailed how an L2 sequencer works. He said users can submit through Base’s sequencer or directly to Ethereum, which preserves decentralization and censorship resistance. The non-custodial structure keeps a withdrawal path if issues arise.

Pollak likened the sequencer to a traffic controller. It sets the order of transactions so the network processes them efficiently. It does not decide prices, pair orders, or act like an exchange.

He addressed the matching engine claim. “Matching engines pair buy and sell orders at specific prices to execute trades. Sequencers don’t do that — they simply determine the order in which transactions are processed,” he said.

Treating L2 sequencers as exchanges would trigger SEC registration and heavy rules, which explains industry pushback.

Why the non-custodial anchor to Ethereum matters

Buterin’s non-custodial point centers on Ethereum settlement. Users can withdraw even if a centralized sequencing service stalls or censors. The design limits the reach of any single operator over funds on Base layer 2.

This model positions L2 sequencers as infrastructure, not exchanges. The AWS analogy reinforces that view and separates computation from market intermediation.

Paul Grewal used that comparison to explain why ordering code differs from matching orders.

Hester Peirce highlighted a narrow edge case around “matching engine” behavior.

Her note drew a line between sequencing and pricing. It also acknowledged that if non-securities move through an L2 sequencer, the SEC has limited scope.

The practical edge case: ordering power and front-running risk

Critics focus on centralized sequencing power during congestion. They point to front-running risk tied to transaction order. The concern is practical, not rhetorical, and it affects onchain markets.

However, the matching engine function still marks the legal boundary. A matching engine pairs buyers and sellers at prices.

An L2 sequencer orders messages for a blockchain to process. The tasks are different in code and in consequence.

Within that frame, Vitalik Buterin underscored the non-custodial link to Ethereum. Base layer 2 continues to describe its L2 sequencer as infrastructure. Coinbase and Paul Grewal lean on the AWS analogy to keep roles clear.

Hester Peirce outlined how the SEC lens depends on securities, exchange definitions, and actual matching engine behavior.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 23, 2025 • 🕓 Last updated: September 23, 2025