WazirX, one of India’s top cryptocurrency exchanges not so long ago suffered a huge security breach, losing $235 million in a hack.

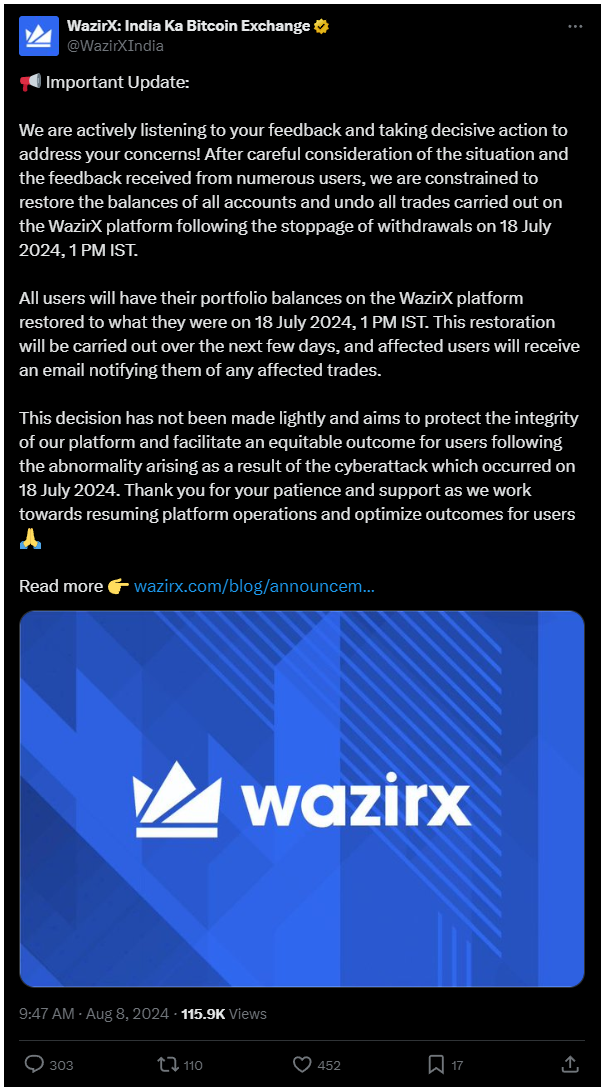

In response, the exchange is taking measures to restore the account balances of all users.

Turn back time

WazirX announced that it will reverse all trades executed after the withdrawal halt on July 18. They stated all users will have their portfolio balances on the WazirX platform restored to what they were on July 18, 2024.

Based on the estimations, this process will last over the next few days, with affected users receiving notifications regarding the reversed trades.

The primary reason for undoing these trades is to ensure fairness among users following the losses caused by the hack. WazirX wants to create an equitable outcome by canceling trades made between July 18 and July 21.

Trades executed after July 18, 07:30 am UTC, will be all invalidated, and portfolios will be reverted to their previous states.

Fees and referrals from these trades will also be reversed. Any fiat or cryptocurrency deposits made after July 18 will be addressed in a future update.

What the hack happened?

Established in 2017, WazirX now is one of India’s largest cryptocurrency exchanges.

The hack was first reported on July 18 by Web3 security firm Cyvers, which identified several suspicious transactions involving WazirX’s Safe Multisig wallet on Ethereum.

A multisignature wallet requires multiple signatures to authorize transactions, and in this case, WazirX’s wallet had six signatories: one from Liminal and five from WazirX.

Who was the weak link?

The breach came from discrepancies between the data displayed on the digital custody platform Liminal and the actual transactions processed on WazirX.

Although Liminal maintained that its platform was not compromised, WazirX claimed otherwise.

A report from Liminal suggested that the exploit was due to compromised WazirX systems.

The attack resulted in the theft of big amount of assets, including at least $100 million in Shiba Inu and $52 million in Ether, which constituted 45% of WazirX’s reserves.

The WazirX still works to address these issues and restore user balances.