You’ve probably noticed that Dogecoin and Apecoin have been on quite a rollercoaster ride lately, and Santiment has some insights into what might be causing these ups and downs.

The FOMO factor

Both Dogecoin and Apecoin recently fell victim to that all-too-familiar feeling of FOMO, the Fear Of Missing Out.

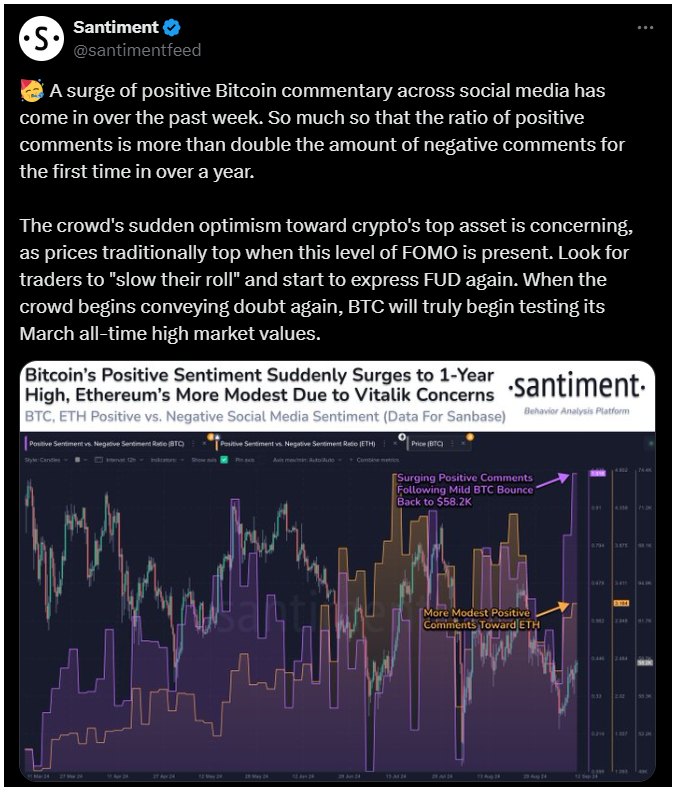

In a post on X, they explained that the “Positive Sentiment vs. Negative Sentiment Ratio” for these memecoins just spiked. This sounds super serious.

Now, what does that term mean? It’s basically a way to measure whether social media chatter is leaning more towards positive or negative comments.

Using a machine-learning model, Santiment can sift through all those tweets and posts to see if people are feeling good or bad about these coins.

When this ratio is above zero, it means there are more positive comments than negative ones. If it dips below zero, well, that’s when the negativity kicks in.

Hype me up

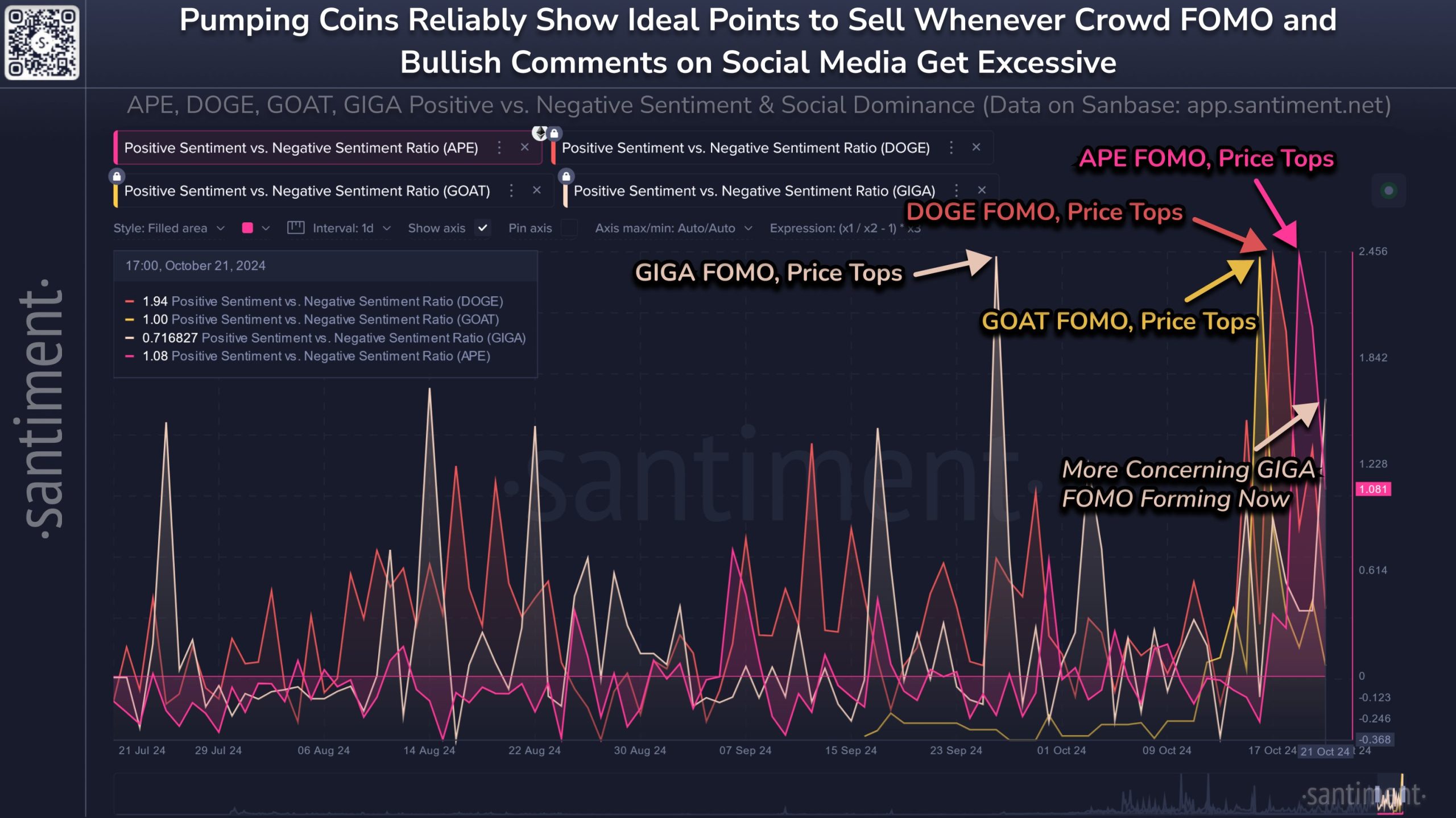

Santiment shared a chart showing how this sentiment indicator has trended for a few different assets over the past months. And guess what?

Both Dogecoin and Apecoin saw some serious spikes in positive sentiment right before their prices hit new highs.

It’s like everyone suddenly decided they were best friends with their favorite memecoins!

Interestingly, two other memecoins, GIGA and GOAT, also followed this pattern but peaked before Dogecoin and Apecoin.

While it’s great to see everyone so excited, Santiment warns that too much positivity can sometimes lead to excessive hype.

And we all know what happens when the hype train goes off the rails, it usually means a price drop is coming. Pump and dump. Boom and bust. Don’t get caught in the middle!

Prices typically go in the opposite direction of what everyone expects, Santiment shared. When people get too extreme in their bullish or bearish feelings, it becomes pretty predictable when to buy or sell.

What’s next for Dogecoin and Apecoin?

Given the timing of these spikes in positive sentiment, it seems like FOMO among investors might be behind the corrections we’re seeing with Dogecoin and Apecoin.

So, what should you keep an eye on? The Positive Sentiment vs. Negative Sentiment Ratio!

If it starts to cool down, it could signal a chance for these coins to regain some bullish momentum.