Ethereum is playing it cool, while corporate wallets gobble up ETH like it’s the last slice of pizza.

These treasury giants have amassed nearly $18 billion in Ethereum per Blockworks Research’s numbers.

Ethereum treasury companies are accumulating $ETH at a record pace! 🚀 pic.twitter.com/WZtCX1HwXs

— Crypto Rover (@rovercrc) September 22, 2025

That’s a monumental pile of digital gold. But here’s where the plot thickens, because traders are piling on leverage like it’s a rollercoaster with no brakes, and that’s making everyone hold their breath.

Price is chilling in a tight range

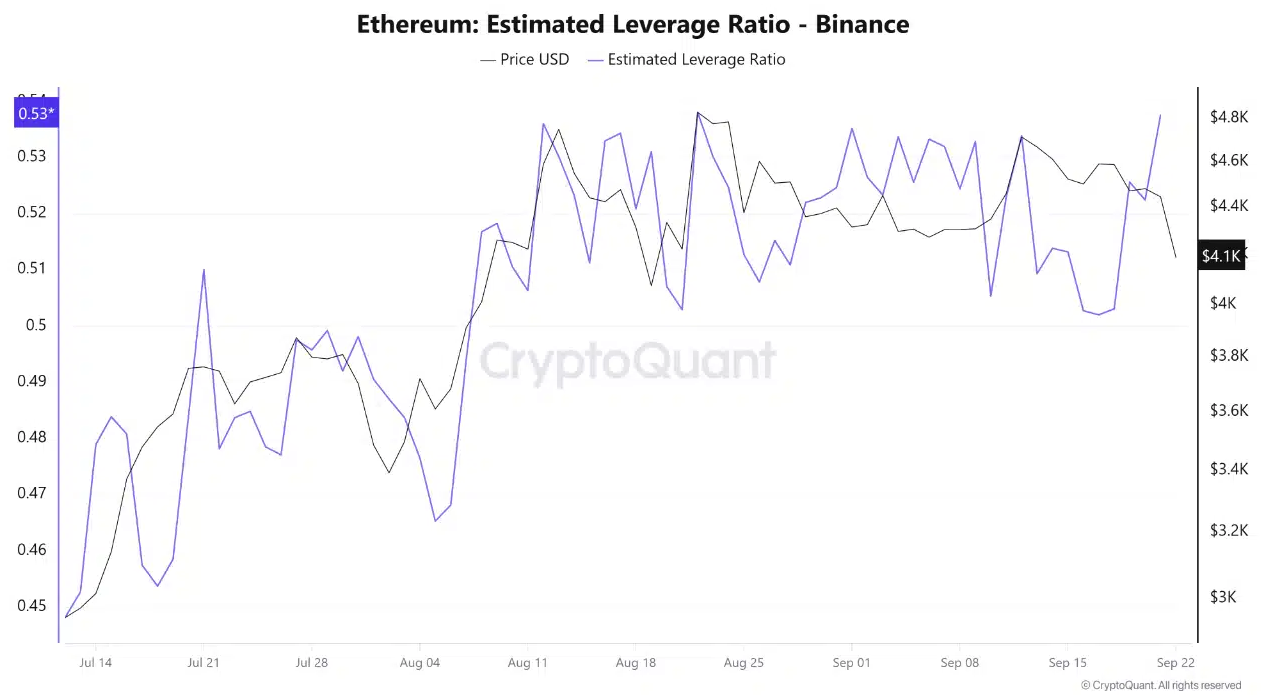

Since July, corporate Ethereum holdings skyrocketed alongside ETH’s flirtation with a $4,800 peak before settling back near $4,100.

These treasury titans seem unbothered by the jittery atmosphere, confidently stacking coins as if volatility were just background noise at a cocktail party.

But underneath the surface, the derivatives market looks more and more like a game of Jenga.

The Estimated Leverage Ratio, which tells us how much risk is baked into the market, shot up from 0.50 to a spicy 0.54 in just three days, one of the highest spikes this month.

Ethereum’s price is acting like a Zen master, chilling in a tight range without too much fuss.

Traders are welcoming risk with open arms tho, slapping on leveraged bets instead of simply buying the asset outright.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Liquidation casualties

Historically, this kind of ELR alarm signals one of two dramatic outcomes.

First, a price jump fueled by relentless buying or second, a nasty tumble sparked by forced sell-offs pushing ETH below $4,000.

It’s a cliffhanger now, where leverage is the wild card, ready to flip the market’s mood in either direction.

If you thought the drama ended there, think again.

The market’s already sweating through cracks. $3 billion in liquidation casualties just hit the books, $900 million of that from Ethereum alone, marking its most brutal single-day purge since 2021.

Smaller altcoins bore the brunt, getting cut down like weeds in a leveraged garden.

Soar or slide

Despite this carnage, Ethereum hasn’t fully unraveled. Market analysts say the big deleveraging party has yet to start.

With leverage stretched tighter than a drum, there’s plenty of room left for another wild ride.

If sellers charge, expect another wave of liquidations to send shockwaves across the market.

So, while the corporate stacks of ETH are impressive and the $18 billion treasure chests glitter, they likely aren’t enough to drown out the thrum of rising risk.

The next move could send Ethereum soaring or sliding, and no one knows which way that lever will pull.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 25, 2025 • 🕓 Last updated: September 25, 2025

✉️ Contact: [email protected]