XRP is entering a tense stretch as long-term holders shift from confidence to anxiety while the token hovers near the $2 mark.

New on-chain and chart data show sentiment weakening just as a bullish flag pattern signals the possibility of an explosive move.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Traders now face a split path: defend key support or watch the market lurch toward a decisive breakout or breakdown.

XRP Long-Term Holders Shift From Euphoria to Anxiety as Price Tests $2

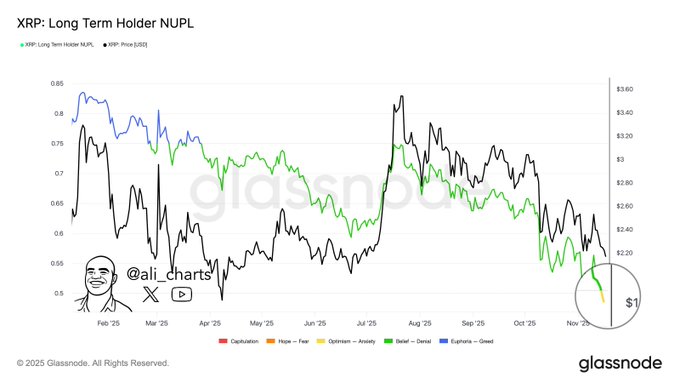

Long-term XRP holders are moving out of the comfort zone as unrealized profits shrink and the token trades near the $2 line, on-chain data from Glassnode show.

The long-term holder net unrealized profit/loss (NUPL) gauge has dropped from the “euphoria” band reached during the summer rally to levels that analyst Ali Martinez now classifies as “anxiety.”

The chart tracks how deeply long-term investors sit in profit or loss by comparing XRP’s market price to the cost basis of wallets that have held for an extended period.

Earlier this year, NUPL hovered around 0.8, signaling heavy unrealized gains and an environment of strong optimism and greed.

As price cooled from its midyear highs above $3, the metric slipped into the “denial” zone, where holders still sat on profits but began resisting the idea of a deeper reversal.

Now NUPL has fallen again toward the “anxiety” band as XRP pulls back toward $2.

That move indicates that a large share of long-term wallets see their cushions thinning, with unrealized gains compressed by the drawdown.

While these holders still sit in profit on average, the rapid decline in NUPL underscores how quickly sentiment can shift when a prior rally loses steam.

The chart also highlights how closely long-term holder behavior tracks major price swings. During the spring and summer, rising NUPL readings aligned with XRP’s climb toward its local peak.

Since late August, however, both price and long-term holder profitability have trended lower, suggesting that earlier buying at higher levels is now under pressure.

Martinez notes that this transition from euphoria to denial and finally anxiety leaves the market at a sensitive point as traders watch whether XRP can defend the $2 area or extend its slide toward lower price zones.

XRP Forms Bullish Flag as Traders Watch for 85% Breakout Chance

Now, on Nov. 19, 2025, XRP is trading near $2.14 and sitting inside a downward-sloping channel that has developed since the July peak just under $4.

This multi-month pullback has carved out what technicians call a bullish flag pattern, a formation where price pauses and drifts lower in a tight channel after a strong rally before potentially resuming the prior uptrend.

The chart shows XRP respecting the upper and lower boundaries of the flag, with the latest candles hugging support along the lower trendline.

At the same time, the 50-day exponential moving average near $2.47 is pressing down as the first key resistance level.

A clean daily close back above that average and the channel’s upper boundary would mark the first technical confirmation that selling pressure is easing and that bulls are attempting to regain control.

Volume has expanded on recent moves, signaling that the current test of support is drawing in more participation.

However, much of that activity still leans defensive as price grinds lower within the channel.

The relative strength index sits around 38, showing XRP in a weak but not yet oversold condition.

That positioning leaves room for momentum to flip higher if buyers step in around the lower band and force a reversal toward the top of the structure.

If XRP breaks out above the upper flag line with strong volume, chart projections suggest that the move could travel roughly 85% above the current price.

From about $2.14, that measured objective points toward the $3.90 to $4.00 region, broadly in line with the resistance level marked near $3.92 on the chart.

Until such a breakout occurs, though, XRP remains in a consolidation phase where the flag’s lower boundary acts as support and the 50-day EMA and upper trendline cap every attempt to rebound.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 19, 2025 • 🕓 Last updated: November 19, 2025