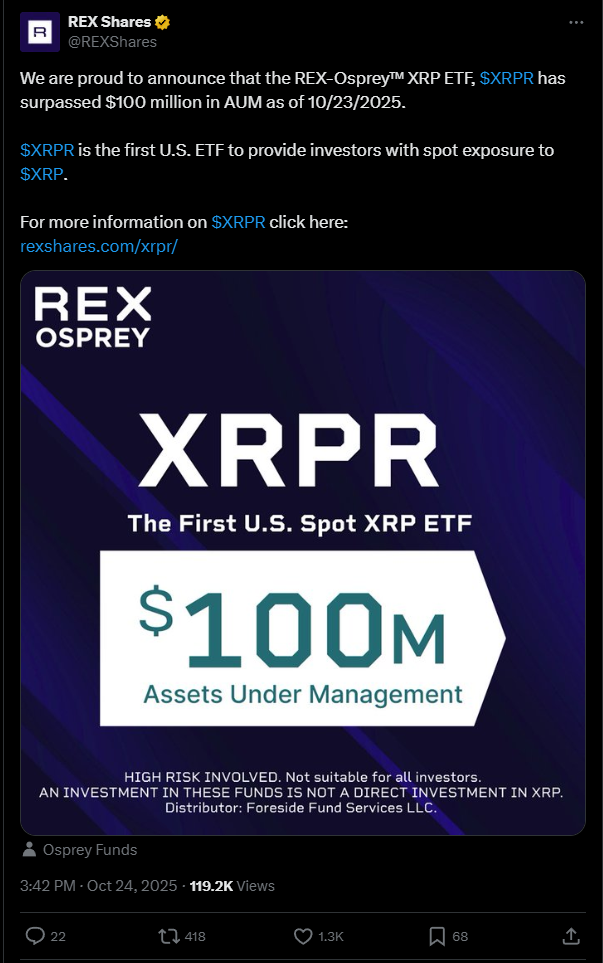

XRP just crashed through a major milestone. The first US XRP ETF hit over $100 million in assets under management barely a month after launching.

That’s a sign that Wall Street suits want their crypto assets regulated and neat, like vintage wine, not wild street fare.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Six pending spot XRP ETF applications

Launched in September by REX-Osprey, this XRPR ETF delivers direct spot access to XRP, giving institutional players a secret handshake into the Ripple ecosystem without dodging the regulatory boogeyman.

The fund’s fast growth isn’t just a speculative flash- Like in case of other crypto ETFs, it’s a huge shift where crypto slides into traditional finance’s cockpit.

Fair to say, the milestone is bittersweet. The US Securities and Exchange Commission is stuck in bureaucratic gridlock.

Since the federal government shutdown on October 1, the SEC has put a hold on decision-making for at least six pending spot XRP ETF applications.

Institutional investors are stuck guessing what moves come next, watching XRP’s momentum like spectators at a betting ring.

$26.9 billion in volume of XRP futures

Also, XRP’s appeal doesn’t stop at ETFs. The derivatives giant CME Group jumped on the bandwagon, rolling out XRP options following solid demand for its XRP futures.

Five months for XRP futures! 💪

Since launching in May, we’ve seen incredible demand for this regulated product. Ready for more control?

Options on XRP futures are officially LIVE! 💥 ➡️ https://t.co/pIwU72fscT pic.twitter.com/Dr0tawBASO

— CME Group (@CMEGroup) October 23, 2025

Analysts are losing their mind as those futures have seen over 567,000 contracts traded, $26.9 billion in notional volume, translating to about 9 billion XRP tokens changing hands. Really nice numbers.

Adding more spice, crypto personality James Wynn declared he plans to pour a hefty chunk of his portfolio into XRP, betting it could revolutionize global banking.

“It’s a gamble, as all investments are,” Wynn admits, but with XRP’s potential to modernize finance, he’s all in.

XRP as treasury asset?

There’s a company, Evernorth, dubbed the “MicroStrategy of XRP,” with plans to hold XRP as a core treasury asset.

Other firms like VivoPower International and Trident Digital Tech Holdings keep quietly stacking XRP, signaling broadening institutional confidence.

Behind the scenes, Ripple is boosting XRP’s infrastructure. CEO Brad Garlinghouse revealed a string of strategic buys, like GTreasury, Rail, Standard Custody, Metaco, all aiming to support Ripple’s cross-border settlement and liquidity muscle. He is making it clear this token is more than a flash in the blockchain pan.

“XRP sits at the center of everything Ripple does.”

So, XRP is shifting gears from speculative digital token to a heavyweight player bridging traditional finance and blockchain liquidity.

The SEC’s glacier pace doesn’t stop the rocket, XRP’s first ETF just launched a high-speed chase through $100 million and beyond.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 26, 2025 • 🕓 Last updated: October 27, 2025

✉️ Contact: [email protected]