Sygnum Bank’s new report suggest that Bitcoin could be in for a wild ride in 2025, thanks to what they call demand shocks.

This growth in demand, driven by institutional investors, might just send Bitcoin’s price skyrocketing.

The sky is the limit, or the Moon?

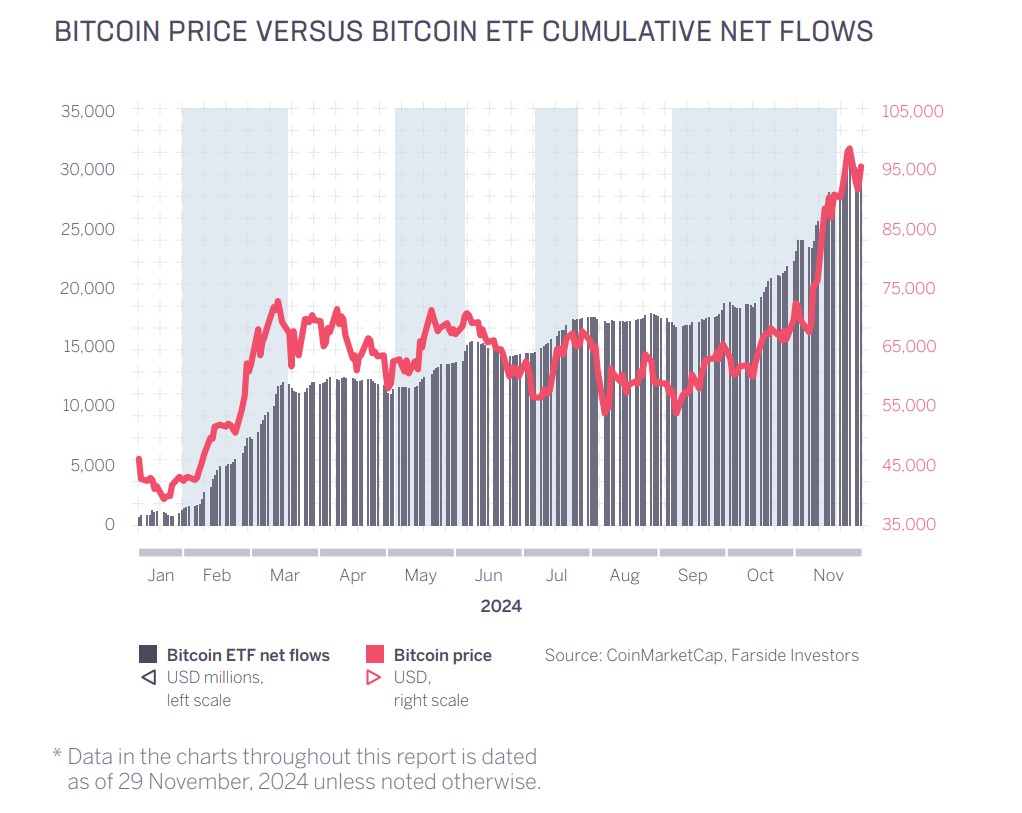

Sygnum’s report highlights how institutional money is already causing some big changes in the Bitcoin market, as they noted that for every $1 billion in net inflows into spot ETFs, Bitcoin’s price tends to jump by about 3-6%.

With major players like sovereign wealth funds and pension funds looking to add Bitcoin to their portfolios, this effect could become even more pronounced in 2025.

Martin Burgherr, Sygnum’s chief clients officer pointed out that as U.S. regulatory clarity improves and Bitcoin potentially gets recognized as a reserve asset, we could see a huge uptick in institutional interest.

He mentioned that even small allocations from these big investors could fundamentally change the crypto market.

Altcoins on shaky ground

Sygnum also warns that unless U.S. lawmakers create supportive regulations for cryptocurrencies, altcoins might not see the same benefits as Bitcoin.

The report stresses that altcoins can only thrive if there are rules that allow projects to deliver value to token holders without drowning them in compliance issues. And now, this isn’t the case.

They highlighted the proposed Financial Innovation and Technology for the 21st Century Act and the Payment Stablecoin Act as important legislations for the future of crypto, plus, the U.S. needs to establish clear laws regarding self-custody, crypto mining, and DeFi too.

Until those regulations are in place, Bitcoin’s strong growth drivers will likely overshadow altcoins.

Sygnum also pointed out that many decentralized applications are struggling with user growth, which has pushed speculative investments towards memecoins, an area that could lead to a bubble.

The rise of Bitcoin ETFs

On a positive note for Bitcoin investors, U.S. Bitcoin ETFs surpassed $100 billion in net assets for the first time as of November 21, and since the launch of spot BTC ETFs in January, Bitcoin has dominated the ETF scene.

Investor interest surged after crypto-friendly President-elect Donald Trump won the elections on November 5.