In May, Bitcoin mining showed resilience despite the recent halving, but concerns remain regarding regulatory scrutiny and market dynamics.

Following the fourth Bitcoin halving, miners’ block rewards were cut from 6.25 BTC to 3.125 BTC.

This time is different

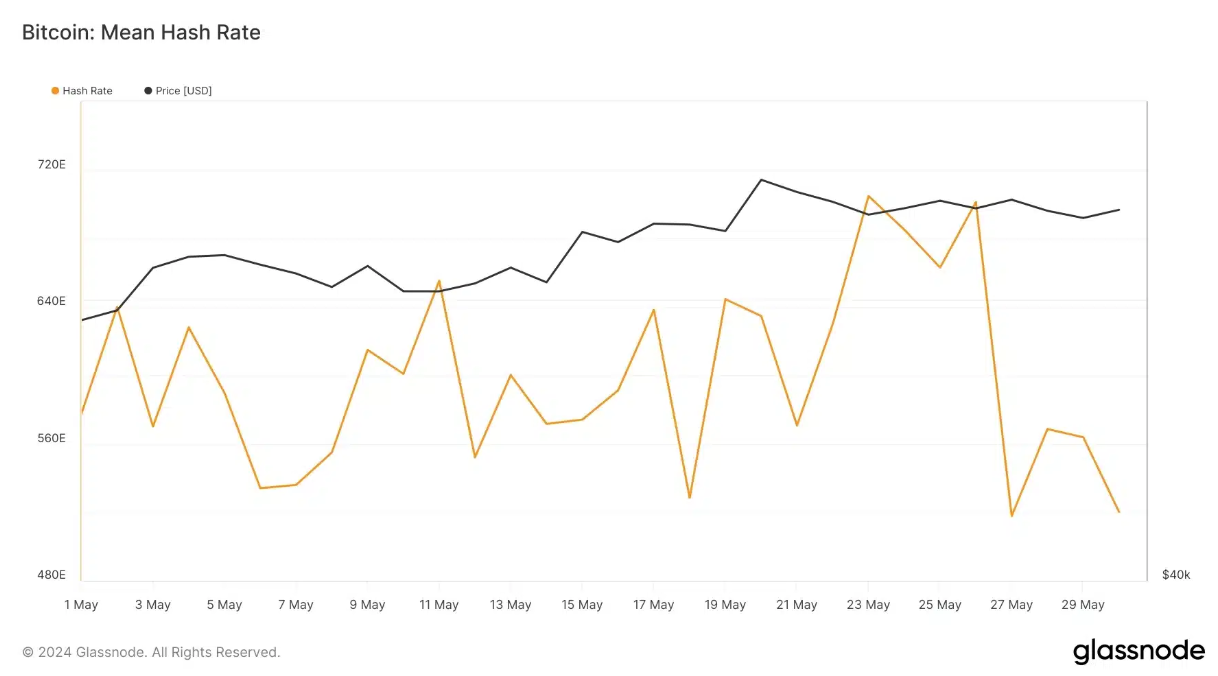

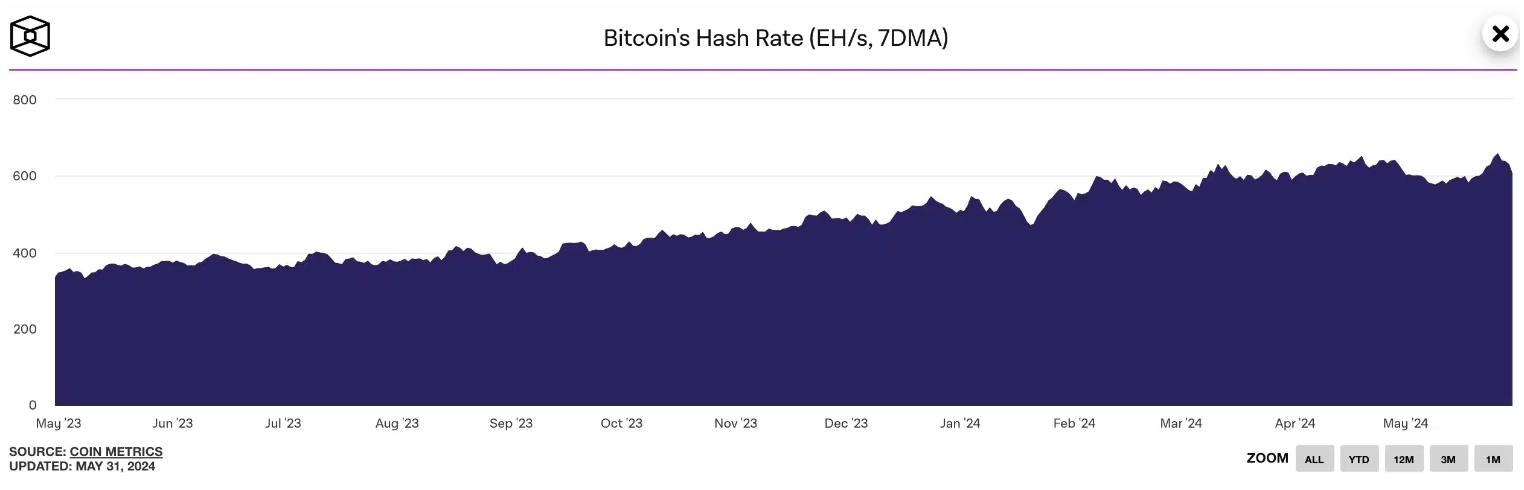

Unlike past halvings, where reduced rewards led to a drop in hash rate, this time it remained near all-time highs, increasing from 630 EH/s to 640 EH/s due to higher transaction fee rewards.

Despite the steady hash rate, Bitcoin’s price has struggled to surpass the $70,000 mark.

On-chain data from The Block indicates a declining hash rate since May 26, and many experts warn miners may find it challenging to maintain profits under these conditions.

Big game, big trophy

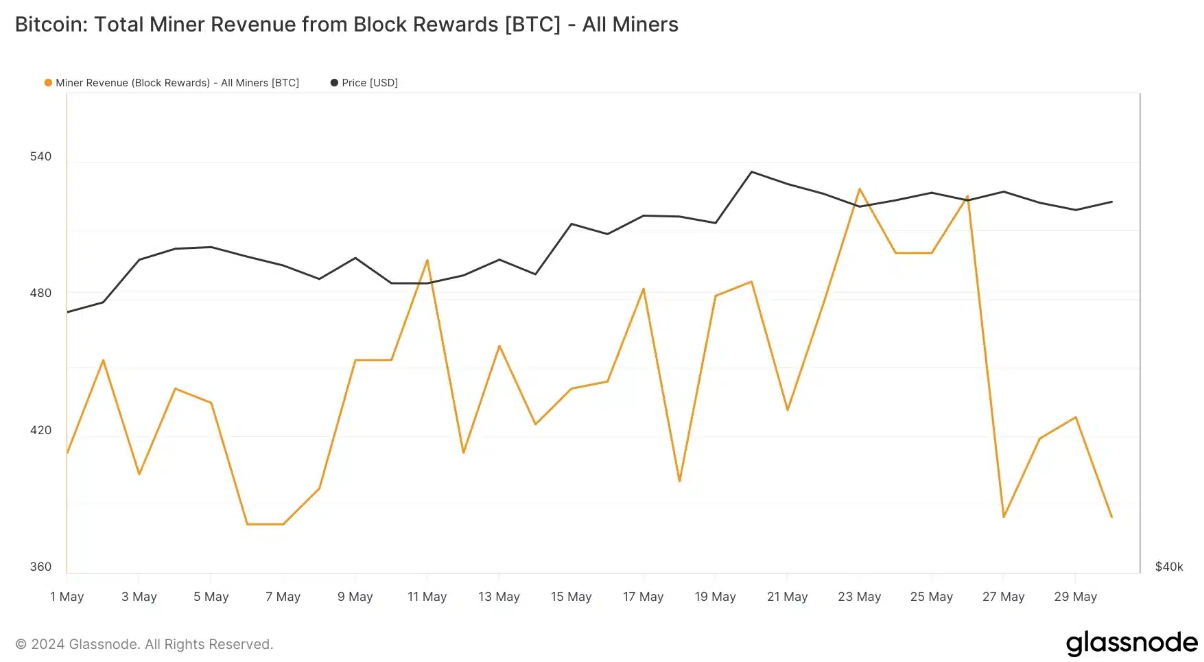

This decline in miner revenue was confirmed by Glassnode’s data too, which showed a big drop from 525 BTC on May 26 to 384.375 BTC in recent updates, but despite this, some analysts remain optimistic, and they argue that miners’ participation suggests confidence in Bitcoin’s future price rally.

The difficulty of mining, which reflects how challenging it is to find the correct hash for each block, plays an important role in determining miners’ profitability, alongside Bitcoin’s price.

Regulation is coming

Another critical aspect of Bitcoin mining involves Maximum Extractable Value (MEV), where miners can profit through strategies like frontrunning and sandwich attacks by reordering transactions within a block.

Recognizing the risks MEV poses to investors, the European Securities and Markets Authority (ESMA) has proposed restrictions on MEV practices, considering them as potential market abuse, as some kind of market manipulation.

The proposal, still in draft form, allows stakeholders to comment until the end of June, and if approved, it could have huge implications for miners and validators globally.

This period post-halving has highlighted the competitive nature of Bitcoin mining, attracting more serious players to the sector, and even with halved block rewards, miners are demonstrating long-term commitment, evident from the growing hash rate and ongoing investments in mining operations.

Next to this, increased regulatory interest from entities like ESMA suggests a future where the mining industry could face more oversight.

This could influence strategies and profitability models.