DeFi Technologies Inc., a publicly traded company on CBOE Canada (DEFI), has announced a strategic shift by adopting Bitcoin as its primary treasury reserve asset.

The company purchased 110 Bitcoin, a move that CEO Olivier Roussy Newton believes will serve as a hedge against inflation and protect against monetary debasement.

Hedge against the inflation

This decision shows the company’s faith in Bitcoin’s potential as a reliable store of value, and speaking to Newswire.ca, Roussy Newton emphasized their belief in Bitcoin’s role in safeguarding assets from inflationary pressures and currency devaluation.

“We have adopted Bitcoin as our primary treasury reserve asset, reflecting our confidence in its role as a hedge against inflation and a safe haven from monetary debasement.”

The adoption of Bitcoin by DeFi Technologies is now seems like a part of a trend where more and more entities recognize the value of a decentralized reserve asset.

This trend, often seen as a game-theory scenario within the Bitcoin network, suggests an ongoing competitive accumulation of Bitcoin among private companies, public corporations, funds, and even nation-states, and experts predict this could lead to an infinite period of hoarding as these entities seek to capitalize on Bitcoin’s unique attributes.

Good company

DeFi Technologies is not the first to adopt such a strategy, as MicroStrategy made headlines with a similar move a few years ago, followed by Japan’s Metaplanet and more recently, Semler Scientific.

These companies have shown a strong commitment to Bitcoin, often raising additional funds to increase their holdings, just like DeFi Technologies announced in the past week.

There is trading, and there is treasury

In addition to this strategic move, Valour, a subsidiary of DeFi Technologies, reported a huge increase in assets under management, reaching C$837 million, around $607 million in US dollars as of May 31.

This marks a 64.9% increase year-over-year, demonstrating the company’s robust involvement in both the crypto market and traditional financial markets.

Valour’s issuance of several altcoin-based exchange-traded products highlights the company’s commitment to the digital assets sector, but worth to mention the parent company has chosen Bitcoin exclusively as its reserve asset.

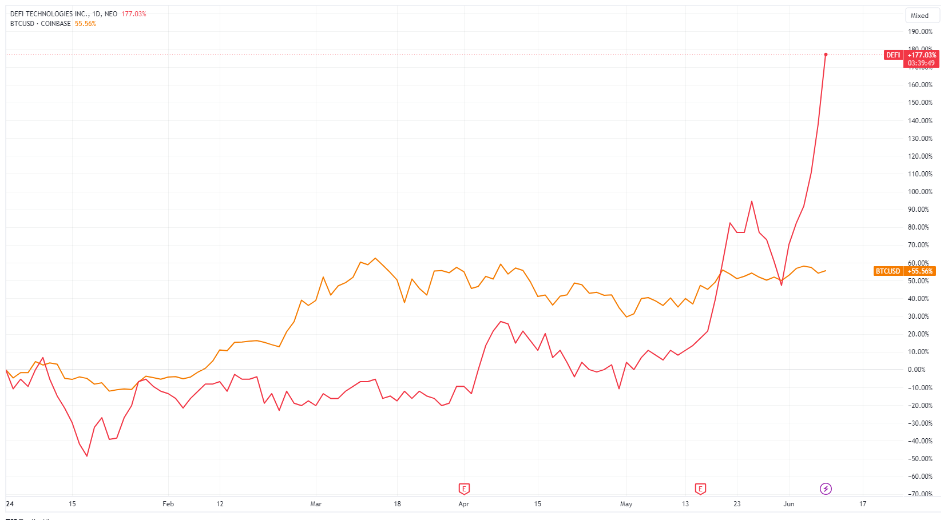

Following the announcement, DeFi Technologies’ share price surged by 15%, bringing its year-to-date growth to an impressive 176%.

This sharp increase reflects investor confidence in the company’s strategic direction and its potential for long-term growth.